Solution of the week: Spending trends

Up, up and away: Nevada is spending much more than it did before the 2003 tax hikes

- Wednesday, January 16, 2013

Editor’s note: Earlier this year, NPRI released Solutions 2013, a comprehensive sourcebook of research and recommendations in 39 policy areas. Now, each week during the run-up to the 2013 Legislative Session, NPRI is highlighting one of these as its Solution of the Week. If you would like NPRI to speak to your organization about this or another policy recommendation, please contact Victor Joecks at vj@npri.org. Solutions 2013 is also available online here.

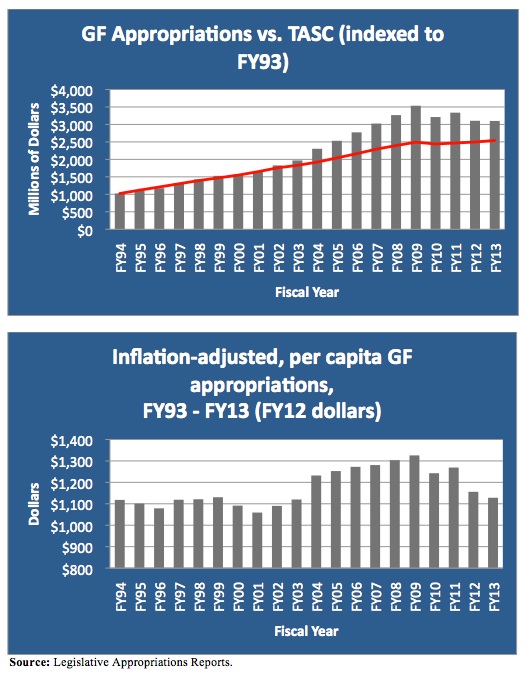

Over the past two decades, lawmakers have more than tripled the size of Nevada’s general fund, growing state spending from $1.0 billion in FY 1994 to $3.1 billion for FY 2013.

During these years, the Silver State’s population has grown significantly, creating additional demand for public services. Lawmakers, however, increased spending at a rate far greater than population growth and inflation combined — meaning that Nevadans face a much higher per‐capita cost of government today than they did 20 years ago.

Key Points

General fund spending is only one component of total spending. Public attention often focuses exclusively on the state’s general fund, because this spending falls under the direct control of lawmakers every two years. However, general fund spending accounts for only about 40 percent of total state spending.

In addition to the general fund, state spending includes federal dollars that are received to help pay for state-administered entitlement programs like Medicaid. Lawmakers have also established, and bear responsibility for, many secondary accounts like the highway fund and the permanent school fund, through which additional billions are spent annually.

The 2003 tax hikes drove the growth in per‐capita spending. Between FY 1994 and FY 2003, inflation-adjusted, per‐capita, general fund spending remained relatively constant. However, following the record-breaking tax increases of 2003, lawmakers began spending significantly more on a per‐capita basis. Between FY 2003 and FY 2009, inflation‐adjusted general fund spending per capita grew 18.4 percent as lawmakers increased employee pay and benefits, expanded the class‐size reduction program, instituted limited full‐day kindergarten programs in Clark and Washoe counties and began financing the Millennium Scholarship out of the general fund.

Despite recent reductions, current spending still outpaces historical levels. Although lawmakers were compelled to reduce per‐capita spending for the 2011‐13 biennium due to negative revenue growth during the Great Recession, inflation‐adjusted, per-capita spending remains higher than at any point in the decade prior to the 2003 tax hikes.

In fact, since the 2003 tax hikes, lawmakers have spent a cumulative $5.5 billion beyond the inflation‐adjusted,per‐capita spending levels that existed in the decade beginning in FY 1994 and ending in FY 2003.

Recommendations

Enact meaningful spending controls to protect taxpayers. In successive legislative sessions, lawmakers have debated whether to enact a constitutional limitation on the growth in state spending. The proposed “Tax and Spending Control” (TASC) amendment would ensure that the real, per‐capita cost of government does not increase over time by constitutionally prohibiting lawmakers from increasing spending faster than the combined rate of population growth and inflation.

Opponents of TASC have argued that Nevada’s spending already has population‐growth and inflation controls on it, since the governor’s Executive Budget proposal is prohibited from exceeding the per‐capita spending level that occurred in the 1975‐77 biennium, indexed for inflation. However, this limitation is meaningless, given that lawmakers are free to add as much spending as they like to the governor’s proposal with no restraint whatsoever.

With TASC in place, lawmakers who are convinced of the merits of higher spending on a given program would first need to find savings elsewhere in the budget.

TASC would offer long‐term certainty to potential investors and job‐creators in Nevada by curtailing the perpetual drive for new taxes.

As such, its enactment should be viewed not only as a centerpiece for fiscal policy, but also as a linchpin for economic development in the Silver State.

Geoffrey Lawrence is deputy policy director at the Nevada Policy Research Institute. For more visit http://npri.org.

Read more: