Nevada is not a low-tax state

Popular narrative conceals impact of high local taxes

- Tuesday, November 29, 2011

It's an argument the Left trots out year after year: "If low tax rates are so important, then why is the unemployment rate so high in Nevada?"

Of course, it's more of a political talking point than an invitation for substantive debate — leftists rarely want to have a discussion about the destructive impact on the Nevada housing market of Federal Reserve policy, the Community Reinvestment Act, federal land control, or countless other federal market manipulations. After all, with Harry Reid steering the U.S. Senate, federal policy surely must be crafted with Nevada's interests at the forefront, right? (Presumably, we are to ignore that per-capita federal spending in Nevada has fallen from 16th among the states to 50th during Reid's tenure in Washington.)

No, leftists in Nevada ask this question to suggest that tax rates don't matter, and that lawmakers could raise state tax burdens on residents sky high with no damage to the state's economy.

Yet, however shallow the Left's economic analysis might be here, it should be recognized that even the underlying premises of the argument are untrue. Tax rates are important ... and they aren't very low in Nevada!

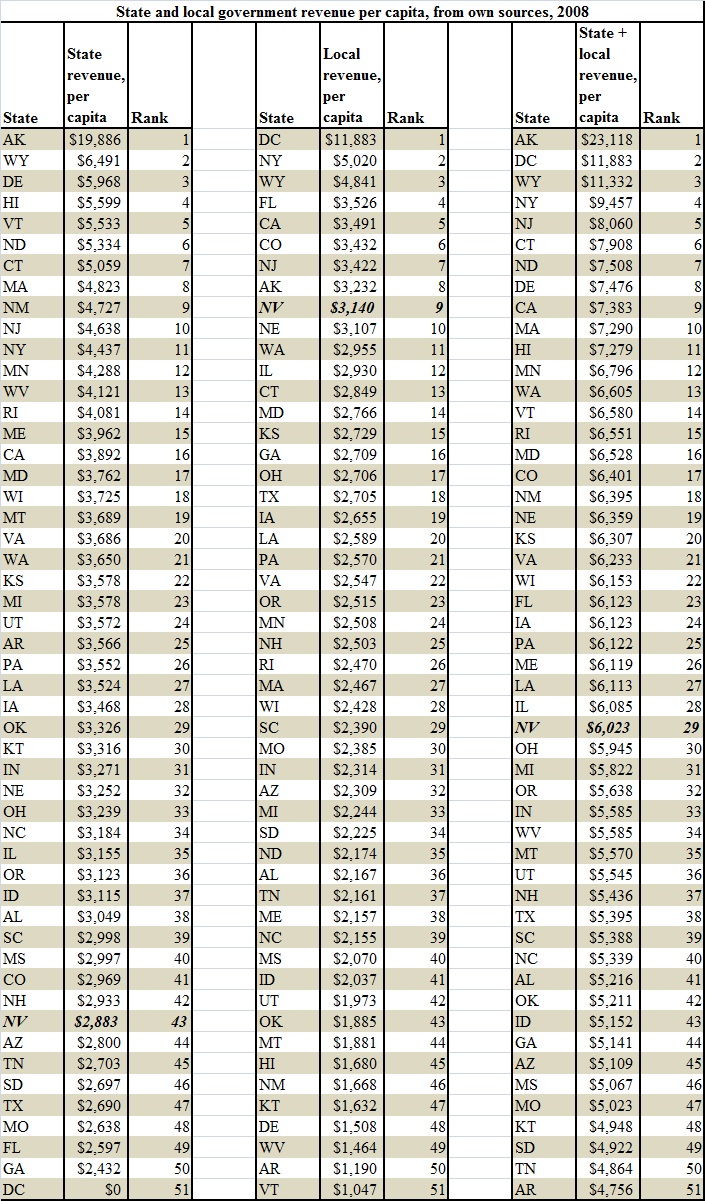

"But wait," says the Left, "data on state and local government finances from the U.S. Census Bureau shows that the State of Nevada received only $2,883 per capita from taxes and fees in 2008. That's 43rd among the states. Surely, our state is starved for revenue."

This bucket might carry water, if one could plug the big hole in it: The same dataset also shows that, on average, local governments in Nevada received $3,140 per capita in 2008 — ninth highest among the states!

In other words, Nevada's relatively low state-tax burden is offset by a relatively high local-tax burden — a product of the fact that services have traditionally been decentralized in the Silver State due to its uniquely far-flung population centers.

Moreover, it is not the state-tax burden in isolation that concerns taxpayers when they decide issues of corporate investment, real estate development, plant construction and the like.

The total tax burden is what impacts a potential investor's bottom line and, consequently, whether he or she will invest and create jobs in Nevada or elsewhere. And once its total tax burden is considered, Nevada is simply not a "low-tax state."

Counting state and local taxes together, Silver State governments received $6,023 per capita in 2008 — 29th highest among the states and merely $97 below the national median.

Also important in making a state attractive as a destination for investment is regional competitiveness. And while Nevada's tax structure is moderately competitive on a national basis, that is certainly not true regionally. In fact, residents in four of Nevada's five immediate neighbors enjoy a lower governmental burden than do Nevadans. If a firm wants to leave high-tax California, for instance, in order to take refuge in a nearby state where higher returns might be possible, it would likely consider moving to Arizona, Idaho, Utah or Oregon before Nevada.

Indeed, the combined state and local tax burden in Arizona for 2008 was $914 less than in Nevada. For Idaho, Utah and Oregon, those figures were $871, $478 and $385, respectively.

Moreover, each of these states offers superior tax-dollar performance, producing higher student test scores and graduation rates and lower crime rates despite spending less money. It's not evident that these disparities exist because Nevada faces unique challenges that the neighboring states do not. For instance, Arizona faces a higher proportion of low-income students who are eligible for free or reduced lunches and a larger proportion of Hispanic students, who are likely to speak English as a second language. Yet, Arizona schools produce much higher student achievement at lower cost than do Nevada schools.

Finally, as Art Laffer has pointed out, investors pay attention to the dominant political forces in states and the direction those forces seek to take those states. And in a state, like Nevada, where government-employee unions and a powerful gaming resort association have conspired in each legislative session for the past two decades to promote a new corporate-income or gross-receipts tax on all businesses — while simultaneously blocking the reforms the state dearly needs — many intelligent investors get the message and back away quickly.

It's time that Nevada leftists and their allies stop asking shallow rhetorical questions contrived to provide rationales for ever higher taxes. Instead, they should be explaining to Nevadans why we've all been forced to pay so much while receiving so little ... and why tax rates shouldn't be cut to make the Silver State more competitive on a regional basis.

Geoffrey Lawrence is deputy policy director at the Nevada Policy Research Institute. For more visit http://npri.org. This article first appeared in the Las Vegas Review-Journal.