Five myths about government spending in Nevada

Nevada governments spend more than you think

- Monday, May 20, 2013

Myth #1: Nevada is a uniquely low-tax state. This is only true if one takes a myopic view of state-level taxes in isolation. What is relevant to taxpayers, however, is the totality of state and local taxes combined. It is the total state and local tax burden that influences consumer behavior, investment decisions and other economic indicators.

Historically, Nevada policymakers have made the conscious decision to concentrate taxes at the local level and not the state level. According to figures from the U.S. Census Bureau, own-source state revenues in Nevada in 2009 amounted to $2,618 per capita. In the same year, Nevada’s local governments collected an average of $3,124 per capita from own-source revenues. In fact, Nevada is one of only seven states that tax more at the local level than at the state level. (The others are Colorado, Florida, Georgia, Illinois, New York and Texas.)

When considered together, the combined state and local tax burden in Nevada amounted to $5,742 in 2009 — 29th highest among the states.

Given Nevada’s status as a Dillon’s Rule state, the decision to concentrate taxes at the local level is a decision controlled primarily by state lawmakers, notwithstanding any claims they may make that local-government finances are out of their hands.

If Nevada policymakers cannot provide quality public services with per-capita tax revenues that hover near the national median, then the fault lies with those policymakers and not with taxpayers.

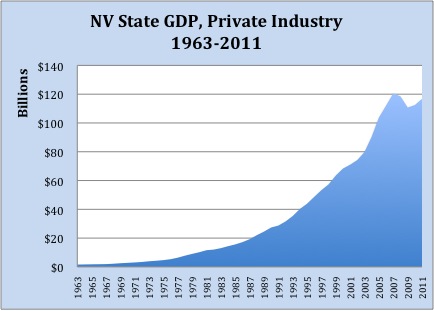

Myth #2: The recession has decimated state and local governments’ ability to provide public services. In reality, Nevada’s private sector has suffered far more from the recession than the state’s public sector. As data from the federal Bureau of Economic Analysis shows, private-sector state GDP declined significantly following the onset of recession in late 2007 — even while government revenues continued to grow.

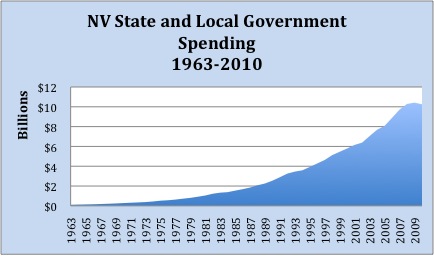

In fact, the impact of the Great Recession on government revenues has only meant a flattening-out of the long-term growth trend visible since the 1960s:

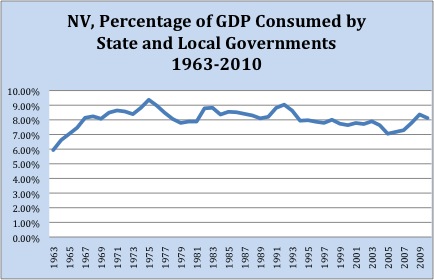

As a percentage of GDP, state and local government spending in Nevada has grown significantly since the early 1960s, when it hovered around 6 percent. It is also significantly higher today than was the case 10 years ago:

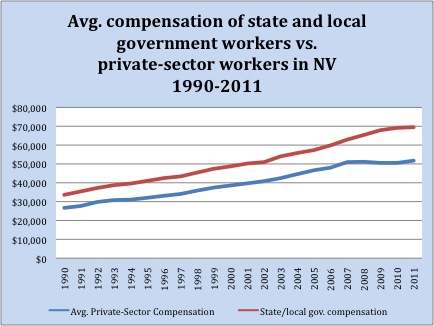

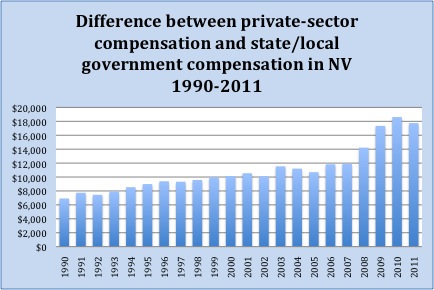

Myth #3: Public employees have suffered major reductions in pay. Despite public rumblings over delayed raises or furloughs for some government workers, data from the federal Bureau of Economic Analysis shows that total compensation levels for state and local government workers in Nevada have continued to grow throughout the recession. This has occurred even while the earnings of private-sector workers have stagnated.

As a result, the average compensation difference between private-sector and state and local government workers has increased from $11,922 in 2007 to $17,744 in 2011. That’s a 48.9 percent growth in this earning disparity since the onset of recession.

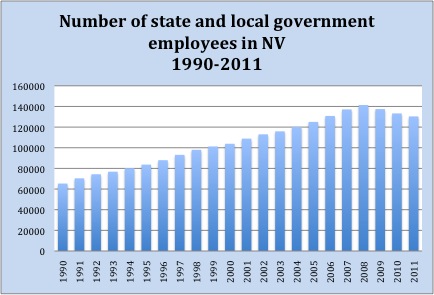

Myth #4: Government-staffing levels have seen major reductions. Data from the federal Bureau of Economic Analysis reveals that Nevada’s state and local government staffing levels have declined by only 5 percent since the onset of recession in 2007. This needs to be seen, however, in the context of the rapid growth these staffing levels experienced in recent decades. Between 1990 and 2008, for instance, state and local government staffing levels increased by 116.5 percent. While that growth rate was roughly in line with overall population growth, rational management and economies of scale at government agencies should decrease the proportion of staffing increases needed as population grows.

Myth #5: Nevada doesn’t spend enough on education. According to official figures from the U.S. Department of Education, Nevada currently spends more on education than do most of its neighbors. In 2009, the latest year for which data is available, Nevada spent an average of $10,499 per pupil. That’s roughly $800 more than was spent in Arizona, $1,900 more than was spent in Idaho and $2,000 more than was spent in Utah. Yet, each of these states boasts higher test scores and graduation rates than Nevada.

Among Nevada’s neighbors, California is the only state whose students perform worse on the National Assessment of Educational Progress than Nevada, despite the fact that California spends roughly $700 more per pupil than Nevada. This fact underscores an important nationwide reality: Little to no correlation exists between spending levels and student achievement.

Student achievement, instead, depends on the policies that direct how precious education dollars are spent. Where strong, positive correlations do exist is between growth in student achievement and:

- the degree of private-school choice,

- the presence of charter schools,

- meaningful teacher-evaluation systems based on student achievement,

- merit pay for teachers, and

- a path to alternative teacher certification.

Given Nevada’s status as a regionally high spender on education, Nevada policymakers have more than enough revenues to deliver a quality education system — if they enact the reforms that are associated with improving student achievement.

Geoffrey Lawrence is deputy policy director at the Nevada Policy Research Institute. For more visit http://npri.org.