Cap-and-trade conflicts with Nevada’s mandates

State renewable portfolio standard incompatible with 'market-based' scheme

- Wednesday, July 1, 2009

Last week the U.S. House of Representatives passed the 1,200-page Waxman-Markey "American Clean Energy and Security Act" to impose new taxes on energy use. The bill is a cap-and-trade scheme that would artificially limit the amount of carbon dioxide that can be emitted by energy users from the combustion of fossil fuels. The bill would essentially create an energy rationing scheme that would require energy producers to acquire costly ration coupons for each ton of carbon dioxide they emit.

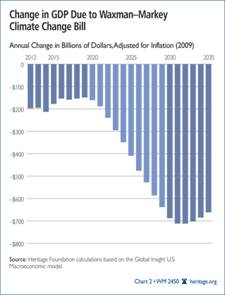

According to an econometric analysis performed by the Heritage Foundation, by 2035 this new energy tax would lower GDP by at least $9.4 trillion cumulatively. In addition to seeing the cost of nearly all consumer products increase because of the new tax, American families would see their direct energy costs "necessarily skyrocket," according to President Obama.

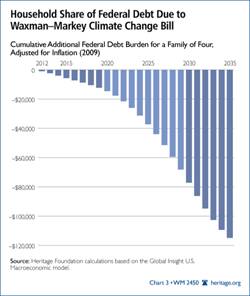

According to the Heritage Foundation's analysis, the typical family of four would see its direct energy costs increase by $1,241 annually as the inflation-adjusted prices of electricity, gasoline and residential natural gas would increase by 90 percent, 58 percent and 55 percent, respectively. These increased costs would reverberate through the economy and lead to the loss of 1,145,000 jobs, while increasing the national debt by an additional $28,728 per person.

An energy tax of this magnitude would amount to an intentional, self-induced recession in the best of times and, in the current climate, to an economic catastrophe.

The ostensible purpose of the new tax is to limit carbon dioxide emissions in order to address "global warming." Carbon dioxide, of course, is a colorless, odorless gas essential for life on earth. Humans and other life forms "emit" it through the simple act of breathing.

Yet, even if one is willing to overlook the many criticisms and the scientific research challenging the entire premise of man-made global warming as the primary driver of climate change, the prospective remedial impact of the new tax on global warming is laughable. According to the federal government's own climate model, the new cap-and-trade energy tax would reduce warming only 0.07 degrees Fahrenheit by 2050 and 0.2 F by 2100. Perhaps it's relevant that the government's climate model has the acronym — no joke — of MAGGIC.

Problems with the Waxman-Markey cap-and-trade tax extend well beyond its high costs and lack of results. Advocates regularly present it as a "market-based" approach to reducing emissions of the stuff that plants need to survive. Cap-and-trade schemes are supposed to allow flexibility and creativity for energy providers, letting them meet the requirements of the cap in the most efficient way possible. Some providers may be able to reduce emissions in a less costly manner and would be able to sell their ration coupons to other providers who face more prohibitive cost structures.

However, the supposed appeal of this artificial "market" disappears completely when one considers that many states, including Nevada, have already implemented command-and-control-style production quotas to mandate exactly how energy is produced. These "renewable portfolio standards" require that electricity providers use specific types of power plants in order to meet consumer demand.

In Nevada, 20 percent of all electricity produced in the state must come from "renewable" sources including solar, wind, geothermal, landfill gas and hydropower by 2015. More specifically, 5 percent of all electricity must come from solar power alone by that date. Further, given that the U.S. Department of Energy has determined that Nevada has very poor wind resources, the practicality of meeting a requirement with that resource is extremely limited.

The result is that the flexibility supposedly incarnate in the cap-and-trade "marketplace" would be nonexistent in Nevada and other states, because this flexibility is undermined directly by predetermined production mandates. (In point of fact, Waxman-Markey would also impose production mandates, although they would be slightly less stringent than Nevada's current law.) These production quotas, imposed by Nevada's renewable portfolio standard, unnecessarily require that electricity be produced by methods both costly and inefficient.

If Congress is intent on raising energy taxes on American families, and Silver State policymakers want to go along, the Nevada Legislature should remove its production quotas for particular technologies. If the purpose of the new federal energy taxes is truly to address "global warming," then there should be no need for the additional burden of production mandates.

The state's imposition of those mandates simply burdens electricity ratepayers for the benefit of elitist rent-seekers in the renewable energy industry — who would use government to force individuals to buy their product.

Geoffrey Lawrence is a fiscal policy analyst at the Nevada Policy Research Institute.