Is Nevada a 'low-tax' state?

Is it bad that I'm already sick of hearing this distortion - that Nevada is a low-tax state - and the session hasn't even started?

The corollary to the low-tax distortion is that Nevada has a relatively small government. For instance, on "Face to Face" last week, Assemblywoman Peggy Pierce, while pushing a corporate income tax, said:

Nevada has, by a very, very large margin, the smallest government in the country.

We have the most conservative government in the country here in Nevada.

Both of these statements - Nevada is a low-tax state and Nevada has a relatively small government - are true in one sense, but false when you look at the complete picture.

Here's the whole truth: Nevada is a very decentralized state, with the Silver State's local governments providing a comparatively greater amount of government services than in other states. Nevada is also a Dillon's rule state, meaning state lawmakers have ultimate authority over local revenues.

Consequently, taxes in Nevada that go to state government are lower than in other states, but local governments in Nevada spend comparatively more in taxes (over which Nevada state government has authority) than in other states. And since Nevada's government is intentionally decentralized, state government is relatively modest, while local governments are more robust.

Overall, Nevada is ranked in the top half of states when it comes to combined state and local tax collections.

The Tax Foundation ranks Nevada 25th in terms of state and local tax collections.

The Brookings Institution ranks Nevada 24th in terms of state and local tax collections.

The Tax Foundation and the Brookings Institution may not agree on much, but they both agree that Nevada ranks in the top half of states in terms of state and local tax collections.

Since Nevada ranks in the top half of states in terms of state and local tax collections, Nevada, despite the conventional wisdom, isn't a low-tax state.

Chamber Report: Education Funding in Nevada

The Las Vegas Chamber of Commerce released an excellent report today, commissioned from Applied Analysis, on education funding in Nevada. For those interested in education policy and funding metrics, the report is certainly a worthwhile read and it further confirms much of what NPRI has said about education spending over the past several years.

One of the unique aspects of Nevada's K-12 education system is the degree to which it is controlled by the state legislature. As the Chamber report highlights:

Nevada's public school system has evolved from one with over 200 fiscally independent districts to today's system of 17 county-wide districts for which fiscal matters are highly centralized at the state level.1 School operating budgets "approved" by county school boards are, in reality, largely created by the state. Local boards cannot impose or reduce any taxes for school operations, even with voter approval. The state also controls school spending, as state support per student for each district is "backed into" by replicating prior-year spending patterns and deducting so-called "local" revenue to the credit of the state general fund.3 Here, "local" refers only to the point of deposit, not to governance, as the State Legislature authorizes and directs the use of these revenues. Nevada school districts operate as de-facto state agencies, and cannot gain from revenue windfalls when they occur, except by legislative act. Given Nevada's low rankings in nationally-administered student achievement tests, this concentration of fiscal authority at the state level is worth revisiting as part of a broader effort to improve K-12.

Despite what Senators Horsford and Raggio errantly argued in the 26th Special Session, the bulk of so-called "local" revenues are, in fact, controlled by the state legislature since the Local School Support Tax is a statewide levy whose rate is determined by lawmakers. Horsford and Raggio argued that they did not control these funds in an effort to misrepresent the size of proposed budget cuts. And they did this only 10 months after they both voted to increase the rate of the Local School Support Tax.

Some other highlights from the Chamber report focus on the fallacy of most state-to-state comparisons given the Silver State's unique financing mechanism:

Comparison with other states and with charter and private schools requires reconciliation of different financial structures and acknowledging restrictions on use of funds. By law, Nevada's "basic support" is not all inclusive; and, therefore, not comparable to other financial measures.

When all district funds are added, expenditures per student might be estimated as high as $12,307; but only if all monies were fungible, which they are not.

For more, I would suggest reading the report in its entirety.

World's lamest PSA?

Let's just say I'm embarrassed to have been born in Washington state.

Pelosi Congress - "most irresponsible ever"

Cato's Richard Rahn has a great piece in the Washington Times today regarding federal tax policy and the debate over extending the Bush-era tax cuts.

Specifically, Rahn cites the historical evidence suggesting income and capital gains tax rates above 30 percent begin to generate fewer revenues - not more - because of the disincentive to work created by punitive tax rates. Allowing the Bush tax cuts to expire for the most productive workers - those who pay the bulk of federal taxes - would not increase federal revenues because, when combined with state income taxes, marginal tax rates would be pushed above 50 percent. However, such a change would lead to a less prosperous and less just society.

Rahn goes on to say "the Pelosi Congress has been the most irresponsible - ever," because of its failure to pass a budget prior to the lame duck session and its failure to act on the Bush tax cuts even though it has had two years to do so. Now, there may not be a vote before the tax cuts even expire, and this uncertainty only exacerbates joblessness as entreprenuers, facing an uncertain cost structure, become reluctant to hire.

How economics saved Christmas

An amazing, economics-themed spin on "How the Grinch stole Christmas!"

Every Who down in Whoville liked Christmas a lot.Head over to Forbes to read the rest.

But the Grinch, who lived just north of Whoville, DID NOT.

He stood and he hated the Whos and their noise

He hated the shrieks of the Who girls and boys

For fifty-three years he'd put up with it now-

He had to stop Christmas from coming, somehow.

He asked and he questioned the whole thing's legality

Then his eyes brightened: he screamed "externality!"

He reached for his textbooks; he knew what to do

He'd fight them with ideas from A.C. Pigou

This idea has merit, he thought in the frost

A tax that was equal to external cost

At the margin, would give all the Who girls and boys

An incentive to stop all their screaming and noise

Failing that, an injunction to make them all cease

And they'd have to pay him to have their Roast Beast.

Has Britain's medical system reached a 'breaking point'? Is the US system far behind?

It's dangerously close, reports the Telegraph.

Financial pressures may mean junior doctors are not given training posts within the NHS and the overall number of places at medical school could drop, a report has said.And with the passage of Obamacare, things aren't looking much brighter for US medicine, either.

This is despite extra burdens on the health service, including European rules limiting doctors' hours, more hospital admissions and people living longer than ever before, according to the study from the UK Royal Colleges of Physicians (RCP).

Those specialties dedicated to looking after very ill people are facing particular strain, it said.

Dr Andrew Goddard, RCP director of medical workforce, said the combination of factors was 'adding further stress to a system which may reach breaking point within the next few years'.

A new survey finds that 40 percent (40 percent!) of current physicians will retire as Obamacare is phased in. Via Investor's Business Daily:

Now a Merritt Hawkins survey of 2,379 doctors for the Physicians Foundation completed in August has vindicated our poll. It found that 40% of doctors said they would "retire, seek a nonclinical job in health care, or seek a job or business unrelated to health care" over the next three years as the overhaul is phased in.Is there a waiver for that?

Of those who said they planned to retire, 28% are 55 or younger and nearly half (49%) are 60 or younger.

A larger portion (74%) said they plan to make "one or more significant changes in their practices in the next one to three years, a time when many provisions of health reform will be phased in."

In addition to retirement, and finding nonclinical jobs elsewhere, those changes include working part time, closing practices to new patients, employment at a hospital, cutting back on the number of patients and switching to a cash or concierge practice.

Audit reveals Nevada hasn't yet cut to the bone

How many times have Nevadans heard politicians or government officials echo the stale talking point of "We've already cut to the bone"?

In case you needed another reminder, no, no they haven't.

A legislative audit of government contracts with current and former state employees has uncovered possible sweetheart deals that one lawmaker says suggest "criminal activity."Great work by the state auditors. Finding out about waste and fraud is the first step toward eliminating it, which is why transparency is so important.

Sen. Sheila Leslie, D-Reno, said that the irregularities -- such as one employee billing the state for working 25 hours a day and another receiving payment of $350 an hour -- should be reviewed for possible criminal prosecution by the Nevada attorney general.

The legislative review focused on state contracts with 250 current and former state employees, who were paid $11.2 million in 2008 and 2009. Legislative auditors said they didn't know how many of those contracts were suspected of irregularities and could not estimate how much the alleged abuse had cost the state.

And speaking of transparency, why isn't Nevada's checkbook online? Since it's necessary to know about waste in order to eliminate it, Nevada's government spending should be as open and transparent as possible.

Another powerful kind of audit is a performance audit.

Performance audits provide an independent assessment of the performance and management of government programs against objective criteria or an assessment of best practices and other information. Performance audits provide information to improve program operations, facilitate decision making by parties with responsibility to oversee or initiate corrective action, and contribute to public accountability.In other words, performance audits don't just ensure that there's no fraud and the money's all accounted for, they also measure the performance of the state's spending.

In Washington state, performance audits have identified $3.5 billion in cost savings over a five-year period at the cost of less than $15 million.

This legislative audit shows the importance of oversight and transparency. Let's hope it's a springboard to even more transparency and oversight.

Why the size of the deficit matters (and doesn't matter)

Couldn't help but laugh out loud at Jon Ralston's column yesterday.

Why? Because in between calling NPRI names and pretending the size of the deficit doesn't matter, he actually made a point NPRI and believers in limited, accountable government, especially in the area of education freedom, have been making for years.

First, let's back up to the beginning of Ralston's column and point out why the budget deficit matters (in one sense). He wrote:

When I hear the ongoing, cacophonous debate over the size of the state budget deficit as Session '11 looms, I can't help but think of two words:In an immediate sense, the size of the budget deficit is immensely important. Assembly speaker-to-be John Oceguera has cited the (inflated) size of the budget deficit as prima facie evidence that Nevada needs to raise taxes.

Who cares?

Size does not matter here. The emphasis by some on a simple math problem - is the deficit closer to $1.1 billion or $3 billion? - is not just unproductive; it's counterproductive. [Emphasis added]

Senate Majority Leader Stephen Horsford has used the size of the deficit to justify his suggestion that Nevada raise taxes by $1.5 billion.

And Ralston himself has previously used the size of Nevada's budget deficit to claim that Nevada needs taxes to balance the budget.

This is a math problem, folks. For those who hated algebra, prepare to wince: You can change the variables to make the numbers work, but you can't make both sides balance without a plus sign somewhere. [Emphasis added]In that same column, Ralston also quotes Guy Hobbs misstating the size of Nevada's budget deficit.

Essentially, cutting $3 billion from the state budget ... you've heard this comparison before ... if you funded just education alone, you could fund nothing else in the state budget.That statement isn't accurate now, nor was it at the time, but you get my point. For months, liberal politicians and advocates of raising taxes used the inflated and inaccurately reported size of Nevada's budget deficit to intimidate and frighten people into thinking that tax increases were the only option.

Refuting this mistruth was, then, the first step toward stopping tax increases and creating an accurate description of Nevada's budget situation. Once the situation is described accurately (i.e., based on the correct assumptions), you can make the case for a balanced budget without raising taxes. (And assumptions are so important to get right, because with inaccurate assumptions, it's possible to "prove" anything.)

But now that the media is reporting accurately on Nevada's budget deficit, Ralston says, "Who cares?" Now that's funny.

Especially since, just a few hundred words after posing his rhetorical question, he notes that Sen. Horsford puts the budget deficit at $2.7 billion and then says, "Horsford is right."

But in a larger sense, Ralston's correct that the size of the budget deficit is irrelevant, because Nevada should be focusing on outputs (priorities), not inputs. Ralston does acknowledge this, though it gets lost in the shuffle.

What's great is that believers in limited government have been making this point for years!

What's the point of education? Not increasing funding levels (which contribute to the size of the deficit). The point is (or should be) student achievement.

And as NPRI has noted numerous times before, nearly tripling inflation-adjusted, per-pupil spending in Nevada over the last 50 years hasn't increased student achievement. There are, however, numerous educational reforms that either save money or are revenue-neutral and have dramatically increased student achievement elsewhere, especially among minority and low-income students.

The next time you bring these reforms up in conversation and someone objects by saying, "But Nevada's not spending enough," remind them of what even Jon Ralston says: "Never has there been a better time to focus on what the state's priorities should be, how they should be funded and what should be excised."

Is the priority how much we spend or the results we achieve? For the vast majority of Nevadans (i.e., for most people who aren't union bosses) student outcomes are a much higher priority than funding levels.

Prioritizing outputs above inputs has many applications - eliminating prevailing-wage laws and reining in out-of-control public employee salaries and pensions are an obvious place to start.

It's also NPRI's main objection to Nevada's current baseline budgeting system, which created the $3 billion shortfall myth in the first place.

Instead of looking at what the state spent in the last biennium and blindly adding roll-up costs, Nevada should institute an outcomes-based budgeting system.

And if you don't agree, remember that even Jon Ralston believes Nevada's focus should be on priorities.

ReasonTV: Great moments in unintended consequences!

Another great video from ReasonTV. Enjoy.

And speaking of unintended consequences, don't forget the negative consequences of Nevada's well-intentioned minimum wage.

Stimulus worked so well, Obama's turning to tax cuts; Updated

News broke Monday that President Obama and congressional Republicans have reached a potential compromise on extending the Bush tax rates. Details included the following:

President Barack Obama reached agreement Monday with Republican leaders in Congress on a broad tax package that would extend the Bush-era income tax cuts for two years, reduce worker payroll taxes for one year and give more favorable treatment to business investments.Aside from the politics of this deal, I'd argue that it's also an implicit admission that tax cuts - especially for rich job creators - are an important factor in increasing long-term economic growth.

The White House is backing a plan touted by Sen. Jon Kyl and others that would set the estate-tax rate at 35% for two years and apply it only to estates over $5 million.

Other elements of the deal include a temporary reinstatement of the estate tax at 35%-the level favored by most Republican lawmakers-as well as an extension of jobless benefits for the long-term unemployed.

And this policy change, even if it's only temporary, is a much better plan for job growth than the $800 billion stimulus plan - an $800 billion spending spree that the folks at e21, using a study by Daniel J. Wilson of the San Francisco Fed, found had a "net job creation [that] was statistically indistinguishable from zero by August of this year."

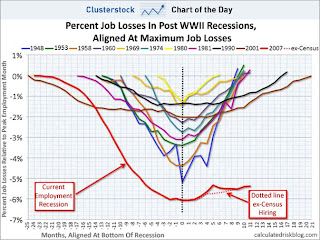

Taken at face value, this would suggest that the stimulus program (with an overall cost of $814 billion) worked only to generate temporary jobs at a cost of over $400,000 per worker.How much of a miserable failure was the stimulus? Business Insider's Chart of the Day has your answer.

The tax compromise isn't necessarily a sure thing, as details of and votes for the tax package are still being worked out. Stay tuned.

(h/t Reason and Hotair)

Update: Or maybe the tax cut package is a brilliant political ploy by Pres. Obama. That's the case made by Charles Krauthammer.

Read more

Read more