Stimulus worked so well, Obama's turning to tax cuts; Updated

News broke Monday that President Obama and congressional Republicans have reached a potential compromise on extending the Bush tax rates. Details included the following:

President Barack Obama reached agreement Monday with Republican leaders in Congress on a broad tax package that would extend the Bush-era income tax cuts for two years, reduce worker payroll taxes for one year and give more favorable treatment to business investments.Aside from the politics of this deal, I'd argue that it's also an implicit admission that tax cuts - especially for rich job creators - are an important factor in increasing long-term economic growth.

The White House is backing a plan touted by Sen. Jon Kyl and others that would set the estate-tax rate at 35% for two years and apply it only to estates over $5 million.

Other elements of the deal include a temporary reinstatement of the estate tax at 35%-the level favored by most Republican lawmakers-as well as an extension of jobless benefits for the long-term unemployed.

And this policy change, even if it's only temporary, is a much better plan for job growth than the $800 billion stimulus plan - an $800 billion spending spree that the folks at e21, using a study by Daniel J. Wilson of the San Francisco Fed, found had a "net job creation [that] was statistically indistinguishable from zero by August of this year."

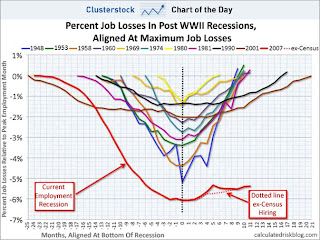

Taken at face value, this would suggest that the stimulus program (with an overall cost of $814 billion) worked only to generate temporary jobs at a cost of over $400,000 per worker.How much of a miserable failure was the stimulus? Business Insider's Chart of the Day has your answer.

The tax compromise isn't necessarily a sure thing, as details of and votes for the tax package are still being worked out. Stay tuned.

(h/t Reason and Hotair)

Update: Or maybe the tax cut package is a brilliant political ploy by Pres. Obama. That's the case made by Charles Krauthammer.