Will Buckley support the gold standard?

In attempting recently to dissect Barbara Buckley's general fund revenue per capita graph, we were only able to ascertain that she adjusted for inflation back to 1996. When trying to "reverse engineer" her graph (we took her 1996 per-capita amount and adjust it to 2008 dollar values to create a starting-point comparison between her graph and ours), it appears as though she is using the population estimates for the beginning of the fiscal year for her general fund per capita calculation.

For example, we believe she used July 1, 1995 population estimates to calculate the FY 1995-1996 general fund revenue per capita. Again, there is nothing wrong with this choice.

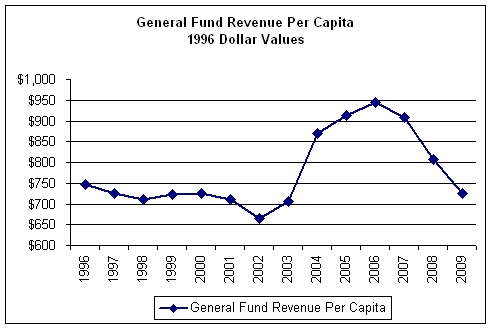

The major difference between her chart and ours was that FY 2009 general fund revenue per capita was below the level for FY 1996 – not that there is anything wrong with this; if Nevada faces rapid population growth rates it should get creative with spending choices rather than listen to the dull-witted demand to raise taxes.

NPRI attempted to replicate Buckley's graph given the available data (yes, we have requested her data, but we have not yet heard back from her). Updated revenue information from the Economic Forum will be available in late November.

Assuming a ridiculous 7 percent population growth for FY 2008 yields similar results to Buckley's graph. However, we believe she would not make that mistake.

Assuming a 6 percent inflation rate between now and the end of FY 2009 yields per-capita revenue results that are below the 1996 per-capita amount. The graph below represents those findings in 1996 dollar values, using population estimates from the beginning of the fiscal year.

A 6 percent inflation rate over the course of this year is entirely possible thanks to major Federal Reserve rate cuts this year. However, for Buckley's findings to be accurate, the U.S. would need to see about a 9 percent inflation rate over the course of this fiscal year, which is possible if the government attempts to solve our economic problems by creating more funny money.

Either way, Nevada's precarious budget situation for FY 2009 is made all the worse by poor federal monetary policies. If Buckley is serious about stopping the boom and bust revenue cycle, not only should she start supporting spending limits and a rainy day fund, but she should also start advocating for a return to the gold standard to stop the Fed's inflationary policy.