The anatomy of a crisis

Nevada's economy faces more trouble than does that of any other state in the country. Rising energy costs, a severe stock market slump and a total collapse of the housing market have led to lower profits, less disposable income for tourists to spend and lower tax revenue.

Pundits, wonks, experts, the media and politicians are all busy trying to diagnose the problem and come up with the solution. Almost everyone outside the classical liberal/libertarian/objectivist/Austrian schools believe that something – anything – must be done.

One result was a $700 billion bailout ($900 billion-plus if you include Freddie and Fannie) that does not even address the root cause of the crisis.

Republicans and Democrats both are busy blaming Wall Street greed. Yes, Wall Street is greedy; it has always been that way. But so are our beloved politicians. They would rather tell us what we want to hear than what we need to hear. They're in the business of getting elected, not making the best economic choices for the country.

The real cause of our collapse was a perfect storm of hare-brained political policies that ignore actual economic realities. The bailout is just one of those policies.

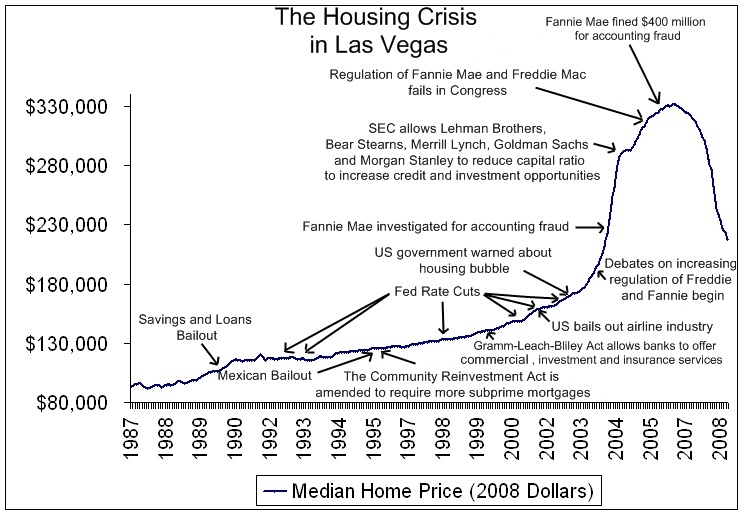

The following graph records some of the government-caused problems that helped lead up to the housing collapse and market crash. Data was collected from the S&P Case-Shiller housing price index for Las Vegas and adjusted to 2008 dollar values.

Click here to download a larger version of this graph.

Too much credit and bad, highly politicized government policies were both major causes of the huge run-up in home prices. There was the politicians' and regulators' major and chronic indifference to moral-hazard issues (i.e., they happily encouraged reckless behavior by rewarding it with bailouts when things went bad). There was the failure of Congress and federal regulators to control fraud and trillion-dollar-recklessness within the government's own Fannie and Freddie agencies.

Most basic of all was the Federal Reserve's interest manipulations, its conscienceless encouraging of the housing and construction industries to take on what sober economists warned was massive risk, and its cheerleading while poor-risk, would-be homeowners were coaxed to jump into high-risk loans (subprime mortgages). All these fueled the fire, pushing the housing-market mania to levels far beyond levels actually justified by Americans' real, un-manipulated, trade-off preferences between saving and consumption.

Eventually, as always happens following central-bank inflationary binges, the discrepancy between the phony interest rates produced by the government's virtual printing of money and the natural rates of interest reflective of consumers' real preferences shows up at our collective doorstep. The recognition begins spreading that people actually don't want all this stuff – all the houses, for example, built with the loans fueled by the Fed's funny money. For example, the people shopping for houses are far fewer than the number of houses they have to choose from, so the descrepancy in demand leads to dropping prices. Even many of the people residing in the new houses don't really, when it comes down to it, want those houses – especially as they eye the increases in their variable-rate mortgages. So, as we've seen, many of these simply walk away.

Others discover that their eyes were bigger than their stomach, or to be precise, their earning power and, upside-down in their mortgages, cannot help but default. As housing prices drop and mortgage defaults increase, companies that went out on a limb, buying bundles of these bad mortgages ("mortgage-backed securities"), or banks that hold a lot of those bad mortgages, find that they made really bad investments and that their bottom line is cratering. This impact is further exaggerated by the banks' previous leveraging as fractional-reserve institutions (i.e., loaning out nine dollars for every one on hand). Now, as their investments dissolve into puffs of air, this multiplier comes back to bite them. The disappearance of their supposed "assets" – and the similar "assets" of other lending institutions throughout society – means a rapid, compelled, de-leveraging of the banks and thus a shrinking of the effective money supply. In other words, after central bank inflation, deflation is Nature's revenge.

The data in the chart is the latest available data as of July 2008, and housing prices have fallen since then. However, as you can see, Las Vegas has a long way to fall before housing prices reach their historical median point, which is around $130,000 (in 2008 dollars) for a single-family home. Housing prices in Las Vegas may still be overvalued by as much as 50 percent.

The myriad bailouts the politicians and the politicized regulators keep trying will only interfere with the needed market correction. Not only will they lengthen Nevada's pain, but they may well end up increasing its intensity.