Refuting the 'rich don't pay their fair share' fallacy

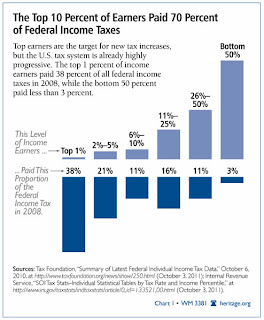

Via the Heritage Foundation, here's how much the "rich" pay in income taxes.

So, the top one percent of wage earners paid 38 percent of the total federal income tax bill in 2008. In comparison, the bottom 95 percent of wage earners paid 41 percent ... combined.

This isn't a one year aberration either. In 2007, the top one percent actually paid more than the bottom 95 percent paid combined.

You might think this fact would be enough to defeat "the rich aren't paying their fair share" fallacy, but I'd respectfully disagree.

The problem with that statement isn't that liberals are wildly misinformed about how much the rich pay in taxes - although that's often true - it's the assumption built into that statement.

Saying "the rich aren't paying their fair share" assumes that government or other members of society have a right to your wealth - at least if you're rich. After all, who determines what's fair, and why does that amount always seem to be increasing?

Now government costs money, and there should be a uniform and low tax rate, but after that, neither the government, your neighbors nor society has any right to your money or mine!

I'm not the first person to come up with this. There's a pretty famous document out there that talks about "certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness."

Once you've paid your taxes, society's "fair" share of your wealth is zero.