NY state will be bankrupt before Christmas

Happy Holidays from one of the most liberal states in the nation.Governor David Paterson called an unusual joint session of the Legislature Monday to implore recalcitrant lawmakers to close the state's huge budget gap before New York runs out of money.If you just listened to liberals in Nevada you wouldn't believe this is possible, because New York has a personal income tax with a top rate of 8.97 percent, a corporate income tax of 7.1 percent, a state sales tax of 4 percent (plus local sales taxes) and some of the highest property taxes in the nation. In all, New York's state and local tax rates are the second highest in the nation. The state should not only have money coming out of its ears, but a tax system that is very stable, because unlike Nevada, New York has both a personal and corporate income tax.

To some lawmakers it's nothing more than a photo op to help Paterson get re-elected. But the governor is dead serious. He said if the Legislature doesn't cut the budget now the state could run out of money by next month.

"We're going to run out of cash in four and a half weeks. We are going to run out of money. Unless we do something about it, (it will) threaten generations," Paterson said.

And so began what is turning out to be a tense tug of war between Gov. Paterson and the Legislature. The governor says $3.2 billion in cuts must be enacted how (sic) -- or else.

But New York's still going broke. What happened?

"Last year, in the midst of this financial crisis, the Senate and the Assembly together with the governor decided to raise spending by $12 billion," added Sen. Andrew Lanza, R-Staten Island.Which is exactly what Nevada did over the past few years.

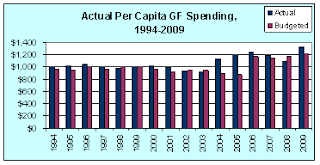

These figures further reveal that the supposed "cuts" to spending made by legislators in the 2007-09 biennium have been overstated significantly. In fact, the figures show that General Fund spending over this biennium is projected to exceed the budgeted amount once again. Many of the supposed "cuts" have not included spending cuts at all, but instead were a series of loans and fund sweeps that allowed lawmakers to prop up spending.The take-away from this (aside from the $1 billion in new taxes the legislature has already taken away from you) is that the budget shortfalls in Nevada, New York and around the country weren't and aren't problems of taxes collected or tax stability. They are spending problems. The desire politicians have to spend other people's money can't be satisfied. It only increases as they get more and more control.

A simple solution to our budget problems is zero-based budgeting, which requires the Executive Branch "to build its budget from scratch each biennium by weighing priorities and evaluating the effectiveness of existing programs." Right now Nevada practices baseline budgeting, in which "the Department of Administration first sets the 'baseline' by determining how much it will cost to continue the existing level of government operations over the next two years. This number increases substantially from one biennium to the next because it builds in so-called "roll-up" costs, such as caseload increases, higher agency assessments and, perhaps most significantly, annual employee pay raises."

For more on this subject, check out the Farm Bureau's excellent piece, Runaway Government Expansion Not Limited To Washington, D.C.