Dodd-Frank bill: putting a cast on the wrong leg

The American financial system has been hobbling on a broken leg for over a decade. Perverse regulatory incentives that required Fannie and Freddie to hold, in their portfolio of mortgage assets, a minimum percentage of sub-prime loans combined with monetary policy looser than Paul Krugman's grip on reality to create an Austrian Business Cycle on steroids.

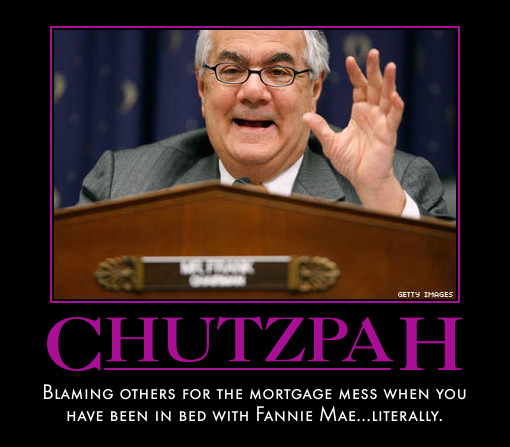

The massive malignment of resources towards an artificially-inflated housing market eventually and inevitably led to a major financial collapse and economic recession. Thanks, Alan Greenspan. Thanks, Barney Frank.

So now Senator Chris Dodd and Rep. Frank are trying to atone for past sins (creating many of the previous regulations that contributed to the collapse) by drafting a brand new financial regulation bill. Problem is, the Dodd-Frank bill does absolutely nothing to address the central problems that led to financial collapse - i.e. regulations requiring or encouraging subprime lending and overly loose monetary policy. Dodd and Frank apparently understand that the American financial system has a broken leg. They just don't know which one is broken, so they're putting a cast on the healthy leg. Gee, I wonder if that will improve ambulation...

It seems the most economically illiterate individuals in the world have amassed themselves in Washington, DC and are running the country. With a complete misunderstanding of financial and monetary economics and the continued push for failed Keynesianism, American policymakers are parading ineptitude.

As one financial analyst is quoted today in the Washington Times:

"The U.S. continues to stick its head in the sand and ignore the animal mating calls of austerity measures [coming from Europe]. A crisis may need to develop before [Washington] wakes up and takes action."

The president of the Bundesbank clearly understands the blunders of Washington as well. He made that clear in a recent Handelsblatt column as reported by the Wall Street Journal:

"Where did the financial crisis begin? Which central bank conducted monetary policy that was too loose? Which country went down the wrong path of social policy by encouraging low income households to take on mortgage loans that they can never pay back?"

In frustration, I will concur with the famed words of Henry Ford:

"It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

Apparently, those who understand the monetary and banking system the least work on Capitol Hill.