Count Taxula

The great thing about government transparency and freedom of information is that the government can't get away with bald-faced lies for very long. So, though the governing class hopes citizens will be left standing ignorantly in the dark while politicians blow billions of dollars on their chums and sponsors, we can still shine light on their nefarious – although, of course, "well intentioned" – activities. The key thing is knowing the right question to ask.

(Spokesman for the 75th Nevada Legislature: "I vant to vaise your taxes!")

As Geoffrey Lawrence has pointed out, this recession is little different from the last one. Then, previous government excess had led to a general-fund revenue shortfall when the economy subsequently weakened. Taxes were raised, ostensibly to maintain "vital programs," but in reality new programs were created and spending was expanded.

This recession is the same. We hear cries about how the sky is falling, doom is impending, and a return to the stone age looms – despite the fact that what is already scheduled is a roughly 5 percent increase in total government spending over the next biennium. But that is not enough; Nevada's governing class wants to increase spending a minimum of 17 percent, so taxes must be raised.

So, we've just raised the room tax, we are poised to raise sin taxes and the regressive sales tax is likely to be increased as well. Rumor also has it that Carson City is looking to double, if not triple, the Modified Business Tax – simply one of the most destructive taxes Nevada's governing class could ever have created. If your goal is to increase unemployment and reduce wages, this is the tax to use.

Yet, tax-and-spenders still aren't happy. They want an income tax, and it has nothing to do with being "broad-based." It has even less to do with making taxes less regressive. In fact, the poor won't care that taxes are less regressive if the total tax burden they have to bear is greater. The tax-hikers should get real: What matters at the end of the day to people is the total amount we are forced to give up in taxes – not taxes as a percentage of our income relative to someone else.

Big spenders want an income tax because that allows government spending a guaranteed increase each time our income levels rise. About the only thing keeping Nevada from becoming the next California, Connecticut or Michigan is the fact that we don't have an income tax allowing politicians unlimited, automatic access to our billfolds.

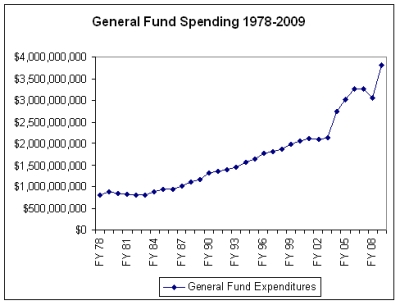

If state lawmakers continue to increase taxes, all they will do is tee up another spending spree, which will lead to our next phony budget crisis. If you need more proof, below is a chart showing general-fund expenditures since 1978. The data comes directly from the office of State Budget Director Andrew Clinger. As you can see, government spending drastically increases after the 2003 tax increase. If you are wondering why spending increased in 2009, it is because state lawmakers evaded adult decision-making to bring spending into line with actual revenues, and instead tried to maintain government spending with fund sweeps and other gimmicks – all to maintain "vital programs," of course.