Publications

The industry winners and losers of the Commerce Tax

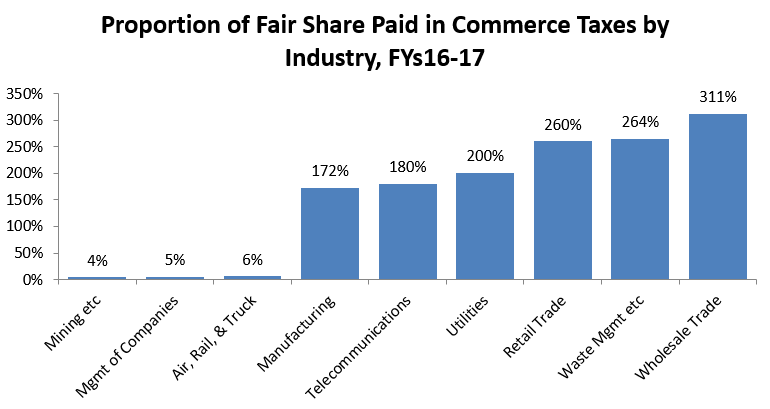

The Commerce Tax favors certain industries at the expense of others

For second consecutive year, statewide revenue growth easily exceeds Commerce Tax revenues

Why, exactly, do we need the Commerce Tax?

Billion dollar increase in Nevada's pension debt will reduce teacher pay, public services

Billion dollar increase in Nevada's pension debt will reduce teacher pay, public services

Statewide revenue growth outpaces Commerce Tax receipts

Even without revenues from destructive gross-receipts tax, education spending set to increase

Tax would cost state, its residents millions

Study shows income losses in the hundreds of millions, job losses in the thousands

Proponents of the margin tax initiative that Nevadans will consider this November want voters to believe that it will only affect “big business,” but reality tells a different story.

Mike Test May 13

test

CCSD air-conditioning woes unrelated to failure of tax-increase push

District narrative sets stage for another campaign to increase your taxes

District officials' narrative sets stage for another campaign to increase your taxes.

State, CCSD shift resources away from ELL high school students

Vegas charter school seeks to meet dire need

The 2013 Nevada Legislative Session: Review & Report Card

Executive Summary

After years during which baseline revenue failed to grow, state revenues were beginning to turn around ahead of the 2013 Nevada Legislative Session. Even with more than $700 million in temporary tax hikes set to expire, Nevada was projected to receive more tax revenue by FY 2015 than it received in FY 2012.