NPRI's Transparency Project on the LVCVA: Apr. 9, 2009 update

- Thursday, April 9, 2009

• Original Dec. 3, 2008 report

• Feb. 4, 2009 update

• Feb. 16, 2009 update

• Apr. 20, 2009 update

• May 19, 2009 update

The Las Vegas Convention and Visitors Authority will gather Tuesday to hear the marketing and lobbying firm R&R Partners explain why it believes its expiring $92 million-a-year advertising contract should be extended.

Yet, after many years, a crucial question still remains unanswered: What is the actual impact of R&R Partners' advertising campaign on the Las Vegas economy?

While there is no debate that advertising plays an important role in driving visitation to Las Vegas, no independent, rigorous financial analysis of the magnitude of the impact of the LVCVA's advertising campaign on the local economy has ever become public. In short, no one knows how much bang for the buck the regional economy is receiving from the massive, collective advertising program.

The LVCVA's primary mission is to drive tourists to southern Nevada. Without an objective measure of the impact of advertising on the economy, it is impossible to determine whether the LVCVA and R&R Partners are accomplishing their goal cost-efficiently for the Nevada public.

Determining the relationship between advertising spending and the regional economy is not an easy task, but it can be done. "In order to do that kind of analysis you need to have money to do it and the time and information," says Keith Schwer, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas. "I don't have that."

The CBER is the most likely candidate to conduct an objective study on the economic value of LVCVA advertising. The analysis would be a daunting task, economists say, because of the number of variables involved and the blanket nature of advertising. But, they say, valuable information could be obtained that would help guide the authority's advertising spending decisions. "I think it would be a great thing to do," says Robert Potts, assistant director at the CBER.

It's unknown whether the LVCVA has conducted such detailed economic analysis. If it has, the authority has refused to release that data despite multiple formal public-records requests for such information from the Nevada Policy Research Institute. Researchers at UNLV also have been rebuffed in their attempts to conduct a fundamental study of the relationship between advertising spending and the local economy.

Billy Bai, UNLV associate professor of tourism and conventions, says the LVCVA has turned down requests by his department to do an empirical analysis of the relationship of advertising and key economic indicators. Bai says the LVCVA told the university that it conducts studies on the effectiveness of advertising but doesn't release the details. "As a marketing professional, I am concerned where we spend the dollars and want to see that the dollars spent generate the numbers desired," Bai says.

What is known is that the LVCVA has adopted a policy that spending on advertising is good, and more spending is better. Through its contract with R&R Partners, the LVCVA in the last six years has spent close to $500 million on advertising. When visitors pack the Strip and casino coffers are full, LVCVA credits its advertising campaign for the boom. When the Las Vegas tourism economy goes into the tank, the LVCVA says even more advertising is needed.

It's the best of both worlds for R&R Partners. The company is not only Nevada's biggest advertising agency, but also the most powerful lobbying firm in Carson City. R&R Partners has held the LVCVA advertising contract for an astounding 29 years and the LVCVA has not sought public bids on the advertising contract since 1999.

R&R Partners' contract has come under increased public scrutiny since last December, when NPRI released a detailed report on the relationship between the authority and the firm. Among the findings, NPRI found that LVCVA internal auditors determined in 2007 that the authority had allowed R&R Partners to operate for more than six years in breach of the advertising agreement. The NPRI investigation uncovered numerous examples of LVCVA steering money to R&R Partners with lax oversight.

This pattern continues. Not even a stunning $53 million drop in room-tax collections that provides 80 percent of LVCVA revenue has blunted the authority's enthusiasm for pumping more money into the R&R advertising campaigns. The 22 percent decline in room taxes forced the authority to slash spending across the board halfway through its 2009 fiscal budget. The exception was advertising, which instead was increased 5 percent, to $92 million. This prodigious spending on the R&R campaigns is in addition to the $33 million the LVCVA spends through its internal marketing department.

At the same time that the LVCVA upped the ante with R&R Partners, the authority shelved its $890 million convention center remodeling project. It also got the state Department of Transportation to delay its call for the LVCVA to fulfill a 2007 agreement with the state and issue bonds as part of its $300 million obligation to fund state highway construction projects. Rather than focus its increasingly scarce resources on "shovel ready" projects, the LVCVA is doubling down on its long-term stance that its near-$100-million annual external advertising budget is essential to the Las Vegas economy.

But where is the proof? Where is the statistical analysis that provides decision-makers with the tools needed to make informed decisions on how to best spend taxpayer funds? Does it make sense to increase advertising at time when consumers are increasing savings and reducing consumption? If so, by how much? NPRI requested interviews with the relevant LVCVA and R&R officials on this subject, but those requests were declined.

Instead of hard-boiled econometric analysis that attempts to determine, as best as possible, how much each dollar of advertising contributes to the overall Las Vegas economy and when is the best time to deploy advertising dollars, the LVCVA focuses its public effort on tweaking its advertising message and congratulating itself for the latest clever pitch.

The authority last spring finally abandoned its "What Happens Here, Stays Here" campaign, which R&R Partners' own internal research revealed had been relatively ineffective since 2004. R&R Research found that more than 70 percent of respondents to its internal monthly tracking poll said the campaign had no impact on their decision on whether to come to Las Vegas. The remaining 30 percent were split, with about 15 percent saying the ad campaign gave them a positive image of Las Vegas and 15 percent saying it left them with a negative perception.

R&R Partners has launched a new campaign urging financially stressed consumers to "Take a Break" by heading to the Strip. The campaign is reminiscent of the McDonald's "You deserve a break today" campaign of the early 1980s, when the economy was also in a deep downturn. But instead of grabbing a Big Mac, R&R Partners urges visitors to satiate their emotional hunger by going to "Vegas Now." So far, nearly a year into the new campaign, there is no indication that recession-weary consumers are biting.

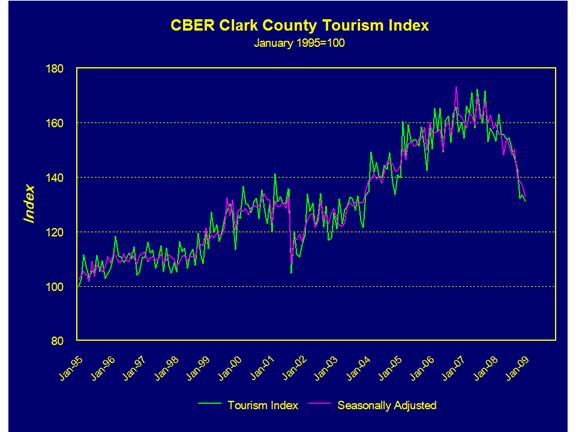

The Clark County Tourism Index published monthly by UNLV's CBER continues to erode at a precipitous rate, exceeded in the last 14 years only by the months immediately following the September 11, 2001 terrorist attacks. The Index, which measures air passengers at McCarran International Airport, Clark County hotel occupancy rates, and Clark County gross gaming revenue, fell every month in 2008 when compared to 2007.

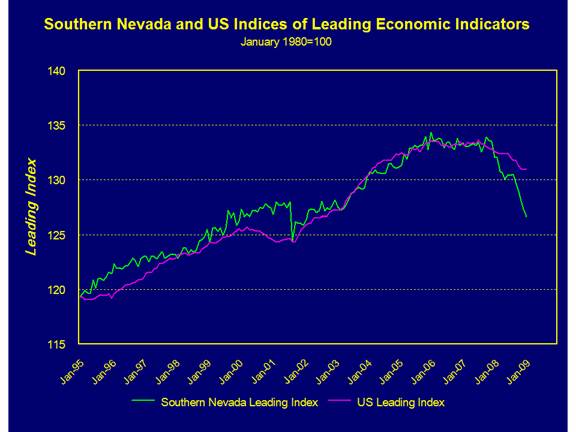

The immediate outlook for southern Nevada's overall economy is also bleak. The CBER's March index of leading economic indicators, which does not include advertising spending among its 10 variables, declined 4.09 percent from 2008, and the index is at a level last reached in 2001. There's no indication it's about to turn positive any time soon, as Las Vegas faces its worse economic conditions since the 1930s.

What impact, then, is the LVCVA advertising campaign having on tourism and the local economy? Would the plunge in the tourism and leading economic indicators indices be even worse if there were no LVCVA advertising? If so, how much? Would the Las Vegas economy receive more benefit from the LVCVA increasing spending on the $300 million in transportation projects it must finance under a 2007 law rather than diverting funds to advertising?

There may not be a definitive answer to these questions, says Jeremy Aguero, a principal with Applied Analysis, a Las Vegas economic consulting firm frequently used by the LVCVA. "For every one dollar spent on advertising, how many visitors are going to come to Las Vegas" is a question that is "very difficult to measure," he says. "I don't know if there is any answer to that."

Aguero is preparing a report on the economic impact of advertising that will be presented at Tuesday's board meeting. But the report is not expected to be a definitive measure of LVCVA advertising's contribution to the regional economy. Aguero noted last month that data has been difficult to acquire.

While the economic impact of advertising on the Las Vegas economy remains unknown, there is some useful data that can provide insight into what drives visitors to come to Las Vegas. "There is a very close relationship between a strong economy and visitation to a destination," says UNLV professor Bai.

Indeed, the rate of change of visitation to Las Vegas has closely tracked changes in the overall health of the U.S. economy for decades. The only notable exceptions occurred in 1990, 1994 and 1999, when the visitation rate to Las Vegas deviated significantly from the overall economy. The sharp spikes in Las Vegas visitation rates in those years appear to be related to the opening of new resort properties on the Strip.

These deviations offer an opportunity for a detailed economic analysis of the impact of marketing by individual resort operators to promote their properties compared to the LVCVA's advertising expenditures focused on promoting Las Vegas in general. What has more impact on tourism, sharp increases in marketing by individual operators promoting their resorts or the LVCVA's steady campaign that keeps the Las Vegas brand in the public arena? Is it necessary for the LVCVA to continue spending upwards of $100 million a year, or is the private sector more effective in driving tourism to Las Vegas?

Preliminary data supports the contention that marketing by individual resorts can have a powerful impact on visitation. For example, visitation jumped 15 percent in 1990 as the national economy was slowing. The Mirage, with 3,049 rooms, opened in Nov. 1989 and the Excalibur, with 4,032 rooms, opened in June 1990, marking the first major expansion on the Strip since 1980. The novelty of the new resorts was likely a driver for increased visitation in 1990 that reached 20.9 million, up from 18.1 million in 1989. The increase in visitation, however, slowed dramatically in 1991 to 1 percent, or 360,000 additional visitors.

The next major visitation spike occurred in 1994, with a 20 percent jump in visitation. This occurred following four years of steady national economic expansion. Visitation jumped to 28.2 million, up from 23.5 million in 1994, as three major resorts opened on the Strip: Treasure Island (2,900 rooms, Oct. 1993), the Luxor (4,407 rooms, Oct. 1993) and MGM Grand (5,044 rooms, Dec. 1993). But once again, the rate of increase in visitation dramatically slowed the next year, increasing only 2.8 percent in 1995.

A third spike in the visitation rate came in 1999 following five years of strong national economic growth, with the opening of four casino hotels. Visitation jumped 10.5 percent to 33.8 million, up from 30.6 million in 1998, as the Bellagio (3,000 rooms, Oct. 1998), Mandalay Bay (3,700, March 1999), The Venetian (4,049 rooms, May 1999) and Paris (2,916, Sept. 1999) opened their doors. The visitation boom carried over into 2000 with a 6 percent increase in visitors to 35.8 million.

Since then, changes in the rate of visitation to Las Vegas have closely tracked changes in the national economy — with one fundamental difference. Unlike 1990, 1994 and 1999, when a surge in new resorts help spur sharp increases in visitation, the addition of more than 10,000 hotel rooms in the last year has only served to further depress the market, driving down occupancy rates and forcing deep discounting. Meanwhile, it is impossible to know what impact the LVCVA's advertising campaign is having on driving visitation because there is no credible econometric model measuring the impact. "It might very well be that marketing dollars is a very big deal," says CBER's assistant director, Robert Potts. But, he emphasizes, no one knows for sure.

What is certain is that a continuing decline in average daily room rate this year — it's already off 23 percent from February 2008 to February 2009 — will further erode the LVCVA's key source of revenue from the room tax. If this trend continues, it will seriously threaten to wipe out the authority's meager general-fund cash reserves, now perilously close to zero.

The next shoe to drop would be evaporation in cash reserves needed to repay more than $368 million in debt - an event that could put the LVCVA in default on $73 million in general-obligation bonds and $198 million in special-revenue bonds. The authority is also carrying $31 million in commercial paper that was borrowed to finance preliminary work on the postponed convention center expansion project. And this doesn't include the authority's obligation to pay for $300 million in transportation improvements required by the 2007 legislation.

"These numbers threaten our very essence," Las Vegas Mayor and LVCVA Board Chairman Oscar Goodman said during the March LVCVA board meeting after hearing the dismal economic forecasts that forced the board to shelve the convention center expansion project for at least a year.

The LVCVA is facing an unprecedented financial crisis as it celebrates its 50th anniversary this month. It only makes sense that the 14-member board of directors has the best information available to make the crucial decisions that lay ahead. The most important arrow missing in its quiver is a sophisticated econometric tool to measure the impact of advertising spending on the Las Vegas economy. Obtaining that tool and measuring the value of LVCVA advertising to the regional economy should be done before, not after, any new advertising contract is extended to R&R Partners, or any other advertising firm.