Memorial Day: Remembering those who died in our nation's service

A history of the day.

A tribute.

Changing of the guard at Arlington National Cemetery. Video after the jump.

Clark County teachers only getting one pay increase next year

They usually get two (plus COLAs), but after Clark County teachers approved a new contract, this year they're only receiving one.

Freezing pay hikes normally given to teachers with every additional year of work is expected to save the district about $15 million. With teachers and other licensed personnel represented by the union - 18,000 in all - accounting for 67 percent of the district's personnel costs, the tentative deal helps to clear a major hurdle to presenting a balanced budget for approval when the School Board meets May 19.I guess this is what they mean by "shared sacrifice." You, the taxpayer, sacrifice and they, the government union members, share in the pay increases.

Ruben Murillo, president of the Clark County Education Association, said the proposed deal with the district would preserve teacher jobs with no loss of benefits or pay. Under the terms of the tentative agreement, teachers will continue to earn salary increases based on educational attainment, such as completing master's degrees. [Emphasis added]

"Our members supported the concept of shared sacrifice," Murillo said.

Funny how sacrifice for a public employee means getting a pay increase, and sacrifice for a private employee means 14.2 percent unemployment.

What's really sad is that we're going to be paying teachers for something - advanced degrees - that has no correlation to improving student achievement (p. 11).

Perhaps most remarkable is the finding that a master's degree has no systematic relationship to teacher quality as measured by student outcomes. This immediately raises a number of issues for policy, because advanced degrees invariably lead to higher teacher salaries and because advanced degrees are required for full certification in a number of states. Indeed, over half of current teachers in the US have a master's degree or more.

It's policy decisions like this that have led to Nevada nearly tripling inflation-adjusted, per-pupil funding over the last 50 years, but remaining stagnant in student achievement.

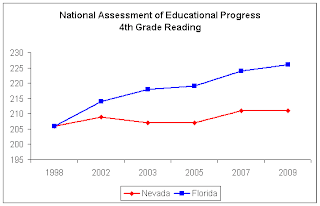

It doesn't have to be this way. NPRI has put forward a proposal that would save Nevada $1 billion over the next 10 years and increase educational freedom, school competition and student achievement. Or we could emulate Florida's educational reforms from 1998. The results speak for themselves.

Daily Show: Marines in Berkeley

Alternative title: The Daily Show destroys Code Pink.

This is old, but also hilarious. I'll have a more fitting Memorial Day post up later this weekend, but with the military on my mind, I wanted you to enjoy this.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Marines in Berkeley | ||||

| ||||

Cutting the budget

Despite the Great Recession - which has resulted in 27 months of continually increasing unemployment - the Nevada Legislature has decided to continue increasing education spending. The spending increases have been so great over the last three years that the recent round of budget cuts to education still leaves K-12 schools with more money this biennium than in the last.

Starting in FY 2008, the legislature increased the level of basic support per pupil and overestimated the number of students that would enroll in Nevada's public schools. This resulted in an appropriation of far more money than was necessary for public schools to operate adequately.

If the Nevada Legislature rolls back basic support per pupil to 2007 levels and adjusts for inflation, the state could see around $250 million in savings.

This figure is estimated by taking the current Distributive School Account figures and simply replacing the FY 2010 and FY 2011 basic support figures with inflation-adjusted 2007 figures. For FY 2010, this would be about $5,000 instead of $5,251. This estimate is, of course, based on the current 2009-11 biennium, and actual savings for the 2011-13 biennium would vary depending on the level of local school support taxes.

Since the quality of education in Nevada has not improved in any statistically significant way since 2007 (or in the last decade) we can reasonably assume the reductions will not harm students. Furthermore, a $250 million reduction would amount to a mere 3.8 percent reduction to K-12 operating budgets for the biennium.

In a state where the private sector wages decreased 12.6 percent and unemployment tripled, a 3.8 percent cut cannot be considered devastating.

U.S. unemployment

Milton Friedman, like many other economists, argued that raising the minimum wage increases unemployment for low-skill workers. Low-skill workers are most likely to be young adults and minorities (who are more likely to be exposed to a poor system of public education and, therefore, are provided a poor foundation for gaining marketable skills).

So how do the unemployment figures look for young adults and minorities?

According to the Bureau of Labor Statistics, unemployment among adults in April averaged 9.9 percent nationally but was 25.4 percent among teenagers. White teenagers averaged an unemployment rate of 23.5 percent, while 37.3 percent of African-American teenagers were estimated to be unemployed. There is no data on teenage unemployment for Hispanics or Asians.

There is also a large disparity in unemployment among adults age 20 and older:

White: 9 percent

Black: 16.5 percent

Hispanic: 12.5 percent

Asian: 6.8 percent

Nevada already has the second-worst unemployment rate in the nation - at 13.7 percent. It may increase as the minimum wage in Nevada will increase to $8.25 for wage earners without insurance - $1 higher than the federal minimum. Expect more teenagers and minorities to be unemployed as a result.

Just Say NO to bailouts for public education

The end of the world ... for public education ... is near!

We hear that refrain all the time. In Nevada we've heard it for the last three years, yet there have been almost no real cuts to public education funding. K-12 education in Nevada is spending about as much as, if not more than, it was three years ago.

In his doomsday warnings, U.S. Education Secretary Arne Duncan claims that without a $23 billion K-12 education bailout, 100,000-300,000 K-12 workers could lose their jobs.

There is just one problem. According to Neal McCluskey of the Cato Institute,

The federal Digest of Education Statistics tells us that in the 2007-08 school year (the latest with available data), US public schools employed more than 6.2 million teachers and other staff. Losing 300,000 of those jobs would only be a 4.8 percent cut - unfortunate, perhaps, but hardly catastrophic.As with most doomsday warnings dealing with public education, the reality is considerably less catastrophic than advertised. More importantly, far more than 5 percent of private-sector workers have lost their jobs.

And 300,000 is the worst-case scenario. The AASA figure of 275,000 would be just a 4.4 percent cut. The low end of Duncan's prediction, 100,000 positions, would constitute only a 1.6 percent trim. That's less than one out of every 60 public-school jobs.

Bailouts are intended to keep poorly functioning entities alive just a little longer, and public education is no exception. Keeping bad schools open and bad teachers teaching is not a good idea - it is a waste of scarce resources. Robert Enlow, president and CEO of the Foundation for Educational Choice, has a better idea - give the money to the parents.

If this president and Congress really wanted to help children and benefit teachers, it would emancipate students so their parents could use their own tax dollars to obtain educational services wherever they wanted - at charter schools, virtual schools or with a voucher to transfer to the private school of their choice. But that's not really what they want. Instead, they want to maintain a status quo that is designed to benefit the adults rather than brighten the future of children.Maintaining the status quo is the express purpose of a school bailout. The problem is, we may not need all these expensive teachers in the first place. In fact, while the number of teachers has grown, student achievement has not. McCluskey states,

Between the 1970-71 school year and 2006-07, inflation-adjusted US public-school spending more than doubled, from $5,593 to $12,463 per pupil. The number of staff per pupil ballooned about 70 percent.

This might have been a fine investment - had it produced anything approaching commensurate improvements in achievement. But it didn't, according to scores on the National Assessment of Educational Progress - the so-called Nation's Report Card.

The U.S. economy will continue to struggle if we keep taking money out of the productive parts of the economy to fund programs that produce little to no benefit for society. Spending excessively on additional teachers when doing so has not produced results has been a waste of money - a $290 million waste of money in Nevada.

Will New York's high income tax rate hurt the Knicks' chances of signing LeBron James?

Forgive the intersection of sports and politics, but this is an interesting case study for how taxes influence decisions.

For those of you who don't read ESPN everyday, LeBron James is the biggest free agent on the NBA market, and where he decides to sign will significantly affect the league for the next few years. He's so good that for the last two years, the New York Knicks traded the majority of their team (and lost a lot of games) in order to clear cap space to sign LeBron and another big-name free agent this summer. Chicago, Miami and Cleveland are also considered to be "in the running" to sign him.

One factor (of many) in his decision is going to be money. Because of the NBA salary cap, he's either going to be making $95 million over five years or $125 million over six years (if he signs with his current team, the Cleveland Cavaliers, or signs with the Cavs and is traded). LeBron also makes about $25 million a year in endorsements, which is likely to increase.

But while the amount LeBron is paid would be the same in each of his potential destinations, the amount he will receive will vary greatly. Why? Because while Florida doesn't have an income tax, New York's personal income tax is 8.97 percent and the rate in New York City is 12.62 percent (include the state income tax). And now, New York politicians want to raise the rate even further.

New York Assembly Speaker Sheldon Silver is reportedly pitching a plan for an increased "millionaire's tax" aimed at 75-85 thousand New Yorkers making $1 million or more a year...Let's do the math. At 13 percent, LeBron James would pay over $35 million in state income taxes alone over the next six years (with current endorsement amounts). Add to that a 35 percent federal tax rate and 6.2 percent tax for social security, and if LeBron goes to New York, after taxes he'll end up with less than half of what he earns.

The plan would jack up a current millionaires tax another 11-percent. The current "millionaire's tax" actually starts affecting people who have incomes over $200,000. High income tax earners would pay more than 13-percent of their salary in local taxes.

Now, influencing Lebron's decision will undoubtedly be many factors - basketball, winning, loyalty, branding - but one factor that no one's talking about is the tax burden that would come with his potential destinations. And since LeBron wants to build himself into a billion-dollar brand, losing 13 percent of his income that he wouldn't be losing in Florida is something he and his financial advisors will likely consider.

LeBron isn't the only businessman who's influenced by taxes. Millionaires have been leaving New York and other high-tax states for years.

CEI sues NASA over FOIA requests

The Competitive Enterprise Institute in Washington, DC has filed suit against NASA because the agency has stonewalled public records requests filed under the Freedom of Information Act for more than three years. Moreover, CEI analyst Chris Horner writes that NASA's supposedly independent temperature record is actually just the same record used by the Climate Research Unit at East Anglia University - the record that was at the heart of the ClimateGate scandal because it had been forged or manipulated.

Massachusetts shows what Obamacare will lead to

A great op-ed by Sally Pipes of the Pacific Research Institute:

The future of US medicine under ObamaCare is already on display in Massachusetts. The top four health insurers there just posted first-quarter losses of more than $150 million. Most of them blamed the state's decision to keep premiums at last year's levels for individual and small-business policies, when they'd proposed double-digit hikes to match the soaring costs they've seen under the state's universal-coverage law.What's going to happen in Massachusetts and its Romneycare sytem? Either insurance costs are going to explode or private insurers will be driven out of business. And what happens once Massachusetts moves closer to a single-payer system? Rationing.

The companies have gone to court to challenge the state's action -- it apparently had no basis for its ruling beyond the political needs of Gov. Deval Patrick. If they win, Bay State health premiums will continue their rapid rise; if they lose, they'll eventually have to stop doing business in Massachusetts -- and the state will be that much closer to a "single payer" system of socialized medicine.

The Massachusetts "health reform" disease means more than just bureaucrats setting prices. It also includes rising government spending and taxes; politicians demonizing doctors, hospitals and insurers -- and patients getting lectured that the restrictions of managed care are good medicine.

It's what's in store for all of America. The Bay State's structure provided the base for ObamaCare. "Basically, it's the same thing," says MIT economist Jonathan Gruber, who was a health adviser to GOP Gov. Mitt Romney and President Obama.

[T]he inevitable next step is rationing at the point of consumption. Massachusetts state Senate President Therese Murray has proposed putting an end to "fee for service" medicine in the next five years and moving to a system of capitated managed care, where doctors receive a flat fee for each assigned patient.Read the whole thing.

This "HMOs for all" approach is designed to lead to soft rationing -- which, in medical terms, means people will have a hard time finding doctors or seeing the ones they have. It's already started. In Massachusetts, one doctor in two is not accepting new patients. Waits for treatment in Boston are the highest in the nation.

This shouldn't come as a surprise to the rest of the country, though. Canada's and Britain's socialized medicine systems have been rationing for a long time.

If you're interested in hearing more from Sally Pipes, check out her speech at an NPRI luncheon from earlier this year.

Nevadans and the federal income tax

According to the latest state fiscal fact by the Tax Foundation, 35 percent of tax filers in Nevada do not pay a federal income tax. This includes individuals that have zero net liability as well as those that receive transfer payments such as the Earned Income Tax Credit. (A family of four with income up to $52,000 may have no federal income tax liability at all.) Individuals who do not file income tax returns are not calculated into this percentage. According to the Tax Policy Center, 47 percent of all American households pay no federal income tax.

At 35 percent, Nevada has the 25th highest percentage of filers that do not pay federal income taxes.

Read more

Read more