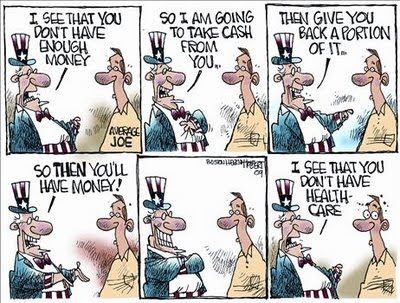

Liberal health care, energy policies raise prices in Nevada

Another reminder that ideas have consequences and that liberal ideas have bad consequences.

First, health care prices are rising dramatically.

Premiums for certain types of health insurance have started to escalate more rapidly than in recent years even though very few parts of the new federal health care law have gone into effect.And energy prices are going up as well.

While some industry observers say it's too early to predict how broad the impact will be, others fear that the rate hikes hint how the Patient Protection and Affordable Care Act will rearrange the insurance market. ...

But local brokers report instances of small groups or individual coverages where premiums have risen in percentages from the mid-teens to the mid-20s, double or more than the average in recent years.

"We are seeing rate increases right now," independent broker Larry Harrison said. "I think there's definitely going to be more increases because of the mandates."

Independent broker Dwight Mazzone said some of his clients were hit with premiums for family coverage topping $1,000 per month, but were able to reduce it to about $800 by soliciting other quotes.

He is advising his clients to budget for 15 percent to 20 percent premium increases.

It's costing a bundle for local power utility NV Energy to comply with a state law that requires it to buy green energy.And it's only going to get worse in the future.

New filings from the company show that it plans to pay 8.6 cents to 13.5 cents per kilowatt hour to buy electricity from seven renewable-power projects included in the 20-year integrated-resource proposal it has pending before the Public Utilities Commission of Nevada.

That price runs two to four times higher than the 4 cents or so per kilowatt hour that the utility paid over the past 18 months for its wholesale power, which comes mostly from natural-gas generation. ...

But everyone acknowledges what the contracts show: Green power costs more than its fossil fuel-generated counterparts.

State law requires the utility to obtain 12 percent of its electricity from renewable sources in 2010; NV Energy executives said recently that they expect to surpass that mandate and get 14 percent of their juice from clean sources this year.Oh, and did I mention that liberal legislators are not-so-secretly hoping to pass the largest tax increase in Nevada's history in 2011?

The renewable portfolio standard maxes out at 25 percent in 2025.

It's a wonder liberals "let" us keep any of our money at all. Oh, the generosity.

The Power of the Dark Side

Who spends more on political campaigns?

A) Microsoft

B) ExxonMobil

C) Wal-Mart

D) American Bankers Association

E) National Association of Realtors

F) AFL-CIO

G) National Education Association

If you said G) National Education Association, give yourself a gold star. In fact, according to Mike Antonucci, author of the recent Education Next article "The Long Reach of the Teacher's Union," the NEA spent $56.3 million in the 2007-08 election cycle, more than all of the above combined!

Between the NEA and AFT (the other major teacher union), the unions spent $71.7 million on political campaigns during the 2007-08 election cycle. The NEA almost always fronts money for politicians and voter initiatives to raise taxes or to fight tax cuts and tax-limitation measures. Naturally, the unions also fight against parental choice and charter schools, both of which limit their influence by decentralizing control over education.

During the 2007-08 election cycle, the teachers unions spent $812,000 in Nevada. Teacher union spending in Nevada amounts to $34.68 per teacher, ranking 11th highest in the nation.

The NEA also funds many left-wing organizations like America Votes, the Economic Policy Institute, People for the American Way, the Center for American Progress, and Media Matters. The NEA also funds dubious academic research centers like Arizona State's Education Policy Research Unit, which is highly critical of charter schools and conservative/libertarian organizations, and the left-wing Great Lakes Center for Education Research, which pretends it's not an NEA front group even though the bulk of its funds come directly from the NEA.

Would an NBA team come to Vegas if Clark County subsidized an arena?

So says Chris Milam, CEO of International Development Management LLC.

"We have an NBA team under contract," Milam said, declining to name the franchise. But the deal will take effect only if "other pieces of the puzzle fall into place: One of those pieces will be that a building (arena) is approved," he said.Now if a developer wanted to build an arena with private money, that would be fine. The problem is raising taxes on others to subsidize private development. And as tempting as it would be politically for commissioners to "create" jobs (and a basketball team) by raising taxes on the arena's neighbors, it wouldn't be the right move economically.

The key to Milam's plan is persuading Clark County to revive its redevelopment area and fund the arena using what is known as tax-increment financing.

Milam is scheduled to make his case to county commissioners at an Aug. 4 meeting.

Commissioners last month discussed arena proposals - three plans have been floated this year - but did not vote on whether they would support construction of any project. Based on their remarks, there appeared to be little support for any arena plan requiring public assistance. ...

Milam's plan calls for resurrection of the county redevelopment district. Developers would then be allowed to keep increases in property tax revenue over current levels. Taxes derived from the district to support the arena would be capped at $125 million.

The 4,000 construction jobs that Milam says would be created would be temporary, and the 7,000 jobs he says would be created either directly or indirectly from the stadium would be mostly part-time and low-paying hourly jobs.

How do we know this? Because that's exactly what happened in other cities where stadium subsidies were sold as economic stimulators.

For many years the "economic boom" idea of building stadiums seemed to make sense and city after state pumped billions of taxpayer's dollars into such projects. But starting in the early 2000s, economists began to have enough data to show that the claims of beneficial end result of building stadiums was not as advertised.The Clark County commissioners don't even need to look to other states to see how redevelopment areas are failing to create jobs. Just check out Las Vegas' redevelopment area.

In fact, these days economists that disagree amongst each other about so much have developed a wide consensus based on the belief that sports teams in and of themselves are not great economic engines for a city and that building giant new stadium complexes are not the automatic boon to the area such as they were sold.

The reason that these stadiums are not as great an investment as previously thought is threefold according to Andrew Zimbalist, the Robert A. Woods professor of economics for Smith College and renowned sports economist. Zimbalist spoke in early 2009 to Freakanomics author, Stephen J. Dubner in the pages of The New York Times.

For one thing, Zimbalist says, the money that will be spent on the events held at the new sports arena or stadium is money spent by local residents. This is not new money but money that would simply have been spent on other entertainment in the metropolitan area if the stadium didn't exist. Secondly, the big money that goes to players, owners and investors does not stay in the area but is invested elsewhere. Third, the city or state is often chipping in up to a third of the continuing costs and this is tax money wasted, not revenue made. ...

There are other problems with these projects, as well.

For one thing, the jobs created are for the most part low paid, part time and offer no benefits. Because of this "jobs" are not really created by a sports complex. Also, very few ballparks have been much of a boon to surrounding businesses. Few people that attend sports events stay around the area in which the stadium sits to shop, eat, or look for other entertainment. They go to the park and then they leave. About the only thing locals get are traffic nightmares and litter.

The prospect of an enlarged Las Vegas redevelopment area received a cool reception Tuesday, with West Las Vegas residents wondering why the supposed economic benefits haven't materialized there while large projects are under way elsewhere.Just another example of why government shouldn't pick the winners and losers in an economy.

The chief concern was jobs. One of the goals of a redevelopment area, which is set up to encourage private investment in struggling areas, is to match residents of the area with jobs created by the investment.

The city of Las Vegas has not measured up to its own goals in that category, acknowledged Bill Arent, the city's business development director. ...

"They haven't been met for any of the projects that have been awarded," said state Sen. Steve Horsford, D-Las Vegas, referring to the jobs goals. Without a clear demonstration of benefits, he said to general applause, "I for one do not believe that this expansion should occur."

County Commissioner Chris Giunchigliani is still strongly opposed to this scheme, and Steve Sisolak is at least wary, so there's hope Clark County will avoid falling into the arena pipedream that has financially trapped other cities.

For ways to increase economic development without redevelopment agencies, check out NPRI's report titled "Rolling the Dice on the Taxpayers' Dime."

Tax Foundation praises NPRI study, warns of the harm of a new business tax

The Tax Foundation just released a new fiscal fact sheet on the tax situation in Nevada.

It not only confirms the recommendations of the Nevada Policy Research Institute's "One Sound State, Once Again" study, it destroys the case liberals try to make for a corporate income tax or gross-receipts tax.

[A] corporate income tax is not a good choice if revenue stability is the goal. As the table below shows, corporate income taxes have proven to be the most volatile of the major taxes, as measured by year-over-year revenue changes. ...Read the whole thing.

This showing of extremely volatile corporate income tax receipts nationwide is consistent with the Nevada Policy Research Institute's calculations for Nevada, and it is consistent with other scholarly work on the topic. Such volatility can be problematic for state budgets, where predictability and year-over-year revenue smoothness is preferred to maintain annual spending commitments. This is especially troubling for a state that has a bi-annual budgeting procedure. ...

An important study released last year by the Organization for Economic Growth and Development (OECD) found that of the various taxes a country can impose, "Corporate taxes are the most harmful tax for economic growth."[3] The administrative and compliance costs of corporate income taxes are also considerable, and scholars across the political spectrum have called for the abolition of state corporate income taxes. ...

The chief economic problem with gross receipts taxes is the pyramiding nature of the tax. [5]That is, since the tax applies each time a business sells its goods or services, the tax "pyramids" on products as they move through the production process. The longer the production chain, the higher the effective tax rate on the final product. This produces major distortions in economic decision-making, with notably negative impacts on low-margin, high-volume businesses. ...

Thus, a gross receipts tax badly distorts and interferes with business investment decisions, leading to lower economic growth and job growth. Sales, income and property taxes do not have the same tax pyramiding feature, making them more economically efficient taxes. An increase in any of those taxes would cause far less economic harm than a gross receipts tax that raises the same amount of revenue.

So what does the Tax Foundation think of NPRI's proposal to broaden and lower the sales tax rate?

Nevertheless, sales tax broadening can eliminate many unjustified exemptions, and if done without favoritism for particular industries and in a way that reduces the overall sales tax rate, can improve the stability of the sales tax while generating new revenue or paying for tax reductions elsewhere.

The Tax Foundation does warn of the dangers of businesses trying to carve out exemptions for their specific industries, and while this would be a problem, it's a problem that you face in any tax system. Taxes should be uniform and low, and believers in the free market are always going to have to defend that principle against liberals and businesses who want a special advantage.

With the legislature's tax study AWOL (Ed Vogel of the RJ mentions this today as well), NPRI's tax and fiscal study is the only recent tax study available for public debate and discussion.

Also: Read NPRI's press release on the study.

Let them eat crow

Once again, the Las Vegas Sun editorial board has ignored the facts in favor of political dogma. Citing Dr. Lawrence Katz, a Harvard economist, the Sun argues that we must continue the extension of unemployment benefits because there are few jobs available for each person who remains unemployed.

Yet Dr. Katz found in a 1990 report that "results indicate that a one week increase in potential benefit duration increases the average duration of the unemployment spells of UI recipients by 0.16 to 0.20 weeks." That's right, the Las Vegas Sun has argued for extending unemployment benefits by citing a Harvard economist who says increasing unemployment benefits increases the duration of unemployment. Dr. Katz isn't alone, as many economists agree.

Here are some more reports reflecting his view:

1. "The probability of leaving unemployment rises dramatically just prior to when benefits lapse."

2. "Job search increases sharply [from 20 minutes a week to 70] in the weeks prior to benefit exhaustion."

3. "It is well established that generous unemployment benefits can increase the duration of unemployment spells and the overall level of unemployment ..."

The most damaging "contrarian" report the political left can point to is a memo from Federal Reserve Bank of San Francisco that found unemployment would have dropped a very modest 0.4 points without the unemployment insurance extension. Still, that represents 600,000 laborers.

So the Las Vegas Sun is most certainly wrong on this one. Extending the unemployment benefits will likely increase unemployment and continue to increase the duration of unemployment in the U.S. The Sun editorial board is advocating a policy that will harm American workers, not help them.

The Sun simply believes that because there are few jobs, we should extend unemployment benefits. But unemployment benefits, and other government policies, may actually be killing jobs. Part of the problem now is that our government is borrowing and taxing heavily to pay for unemployment benefits - this means less capital for businesses to create jobs. Furthermore, government subsidies, bailouts, licensing, tariffs, wage regulations and stimulus packages have done nothing but shift resources from high-valued uses to lower-valued uses. Thus, at best, they have created no jobs and at worst have actually destroyed jobs (more on this at Marginal Revolution).

Finally, maybe the Las Vegas Sun editorial board can explain why they seem to think that unemployment benefits, which could be kept for up to 99 weeks in some states, have had little to no effect on increasing the average duration of unemployment to a record-shattering 35 weeks?

Infighting over education

More on the infighting in the Democrat party as one side wants to fund jobs for adults with money for education reform.

Free trade starts at home

The Institute for Justice defends a small Minnesota farm from anti-free trade statutes that prevent them from selling flowers, pumpkins and Christmas trees in their own hometown.

Gov. Schwarzenegger vs. Gov. Christie

From Chuck Asay:

More Christie here and here.

Creating free markets in health care

Where to cut: Public employee salaries

The headline from the RJ says it all: "Public employees' pay keeps rising."

Government employees in Nevada continued to get healthy raises during 2009, while the average privately employed Nevadan took a pay cut, according to a new report from the Nevada Department of Employment Training and Rehabilitation. The raise gap was especially evident for those employed in Clark County.The difference was even more dramatic in Clark County.

"Nevada Employment and Payrolls 2009," when compared to the 2008 edition of the report, shows the average private sector wage declined $13 a week, from $804 to $791. Local government employees, however, got about $47 more a week than they did in 2008; their average pay increased from $949 to $996.

That's a pay cut of 1.6 percent for private workers, compared to a raise of nearly 5 percent for local government employees.

Private sector wages dropped from an $808 average to $790 a week, while local government wages climbed from $990 to $1,052.How do their salaries keep increasing? Salary increases for which government employees are eligible include: cost-of-living adjustments, step increases, longevity, merit bonuses and more money for increased certifications. Even if some increases are eliminated, public employees can still receive overall salary increases, because they get a raise from another category. That is why even when public employees offer "concessions," their salaries still increase. They aren't taking a pay cut or freeze, they are just taking a decreased increase or, as it's known in the private sector, a pay raise.

That's a 2.2 percent cut for private workers, compared to a 6.2 percent raise for the local government employees.

For instance, the Las Vegas firefighters union just approved a revised contract with $5.6 million in salary concessions. It sounds like firefighters will be getting a salary cut, but when you read the details of the contract, you find that most of these savings are from decreasing scheduled pay increases and that the firefighters are still receiving a salary increase in the upcoming year. Only in government do wage "cuts" result in a pay increase.

The next time someone bemoans the state of Nevada's finances, remind them that it's a spending problem, not a revenue problem, and that the increase in public employee salaries is one of the first places elected officials should look to cut.

Read more

Read more