Reid, Sandoval agree: Don't raise taxes in 2011

Bookmark this interview. We may need to reference it during the next legislative session.

Over the weekend, the Las Vegas Sun posed 10 questions to gubernatorial candidates Rory Reid and Brian Sandoval.

The second question concerned taxes, and both candidates said that they wouldn't support raising taxes in 2011.

Is there any circumstance in which you would consider raising taxes or renewing taxes set to expire next year?Kudos to the Sun for asking about the expiring tax increases as well. Remember that extending a tax increase is ... a tax increase.

Reid: Now is not the time to raise taxes on Nevada families. People are hurting, with unemployment and foreclosures at an all-time high, and we can't aggravate the situation further by taking money out of families' pockets. However, I will not cut education further because strong schools are the key to building a better economic future and attracting new jobs.

Sandoval: No. I believe that raising taxes is exactly the wrong thing to do. As a former judge, I look at the evidence, and nowhere have I seen any evidence that raising taxes creates jobs.

Now the real question is: What would each candidate do after the election?

Two years ago, Sen. Steven Horsford and Sen. Bill Raggio both said that they wouldn't support raising taxes. Just a few months later, though, both supported a record-setting, billion-dollar, job-killing, secret tax increase during the 2009 legislative session. And they weren't the only politicians who lied about their position on taxes.

Is either Reid or Sandoval misleading the public (or himself) on his position on taxes? I don't know, but taxpayers who are concerned about legislators trying to raise taxes in 2011 need to ask each of the candidates again and again about their position on taxes and how they plan to reduce or reform Nevada's spending. (NPRI's alternative budget is a good place to start.)

Also, with news breaking last week that the tax study is now just going to be a wish list of government spending, both Reid and Sandoval should consider the recommendations in NPRI's tax study, "One Sound State."

And as the only current tax study available, "One Sound State" is also a valuable reference tool for candidates and citizens. For instance, did you know that Nevada's Modified Business Tax is much more volatile than our sales or gaming taxes? You would if you read "One Sound State."

Also, the Transparent Nevada blog has a post on Reid's and Sandoval's answers about requiring transparency in union negotiating.

NPRI analyst: As tax-study scheme crumbles, lawmakers should consider 'One Sound State'

With news breaking this morning that the Legislature has cancelled part of its tax study, the Nevada Policy Research Institute released the following:

NPRI analyst: As tax-study scheme crumbles, lawmakers should consider 'One Sound State'

LAS VEGAS - A fiscal policy analyst with the Nevada Policy Research Institute said today that the Interim Finance Committee's partial cancellation of its contract with Moody's Analytics, which the IFC hired to study the state's tax structure, means that the legislature is now essentially paying for a spending wish list from the Nevada Vision Stakeholder Group with no plan for determining how to pay for it.

"From the beginning, the legislature's agenda has been clear: spend tax dollars to create a wish list of government spending and use that wish list to justify massive tax increases during the 2011 Legislative Session," said Geoffrey Lawrence, the NPRI analyst. "Now the Interim Finance Committee has decided just to let the Nevada Vision Stakeholder Group develop five-, 10- and 20-year spending goals without any concern for how to pay for them."

The Nevada Vision Stakeholder Group is comprised mainly of government officials, union members and others who profit from government largesse. The group is scheduled to complete its "quality of life" report by September 15, 2010.

"This new scenario must be a dream-come-true for leftist politicians," said Lawrence. "Just in time for the 2010 elections, it allows them to make grand promises about achieving 'quality-of-life' goals without requiring any actual proposals for how to fund them. Just as they did in 2009, those politicians, once in office, will likely propose massive new tax increases that will only exacerbate Nevada's boom-and-bust spending cycle."

Lawrence noted that Senate Majority Leader Steven Horsford has already signaled his support for a corporate income tax, which is not only the most volatile of all major tax instruments available to state governments, but would also transfer wealth from Nevada's successful job creators to a group that failed even to complete a study about how to raise taxes.

"If the legislature and the IFC can't even complete a tax study, then why should citizens trust them with more tax dollars?" said Lawrence.

"Fortunately, there is a tax study that has been completed, and it didn't cost Nevada taxpayers a dime," continued Lawrence, in reference to the "One Sound State, Once Again" tax study he authored for NPRI earlier this year. "The NPRI study offers a series of revenue-neutral recommendations that would broaden, stabilize and simplify Nevada's tax structure and smooth out Nevada's boom-and-bust spending cycles."

Lawrence said that since the legislature has failed in its attempt to examine the state's revenue structure, citizens, candidates and lawmakers would do well to read and debate the recommendations in "One Sound State."

More information:

NPRI's tax study: "One Sound State, Once Again"

Tax Foundation: "Nevada Panel Considering Tax Reform Options, Including New Business Taxes"

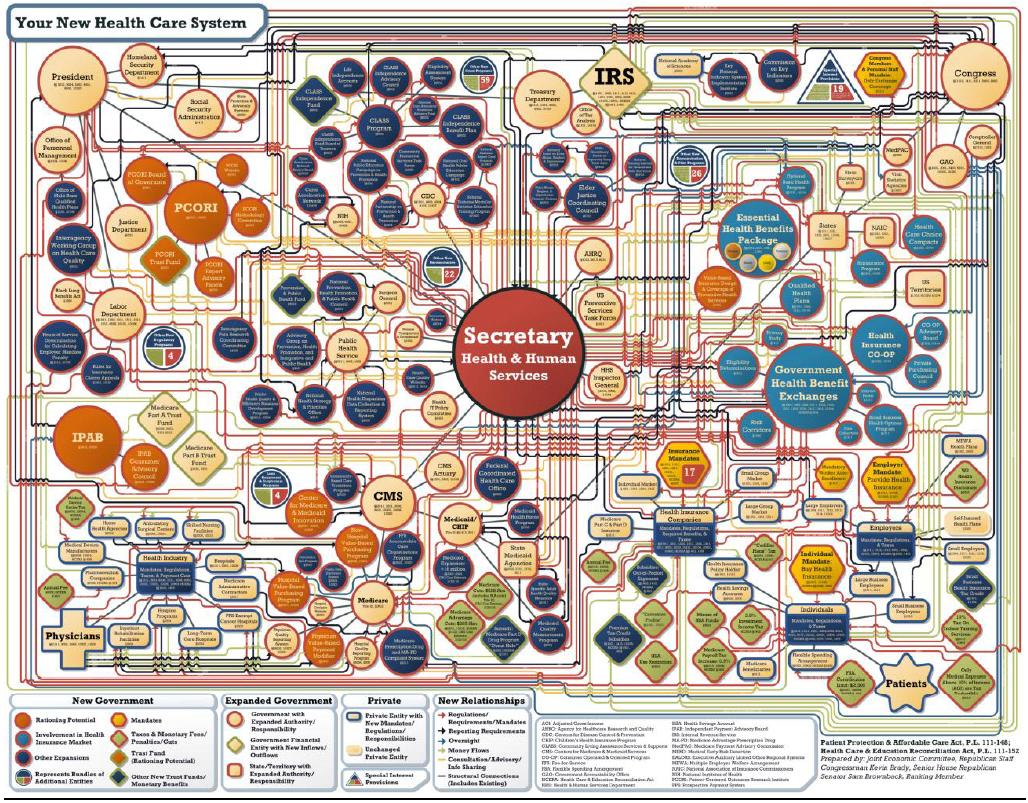

Health care plans

Hat tip to Daniel Mitchell of the Cato Institute.

Tax revolts

More from Bell, California. But remember, North Las Vegas had a fire fighter that made $661,000 in 2009...

Podcast: Tax Foundation interviews Geoffrey Lawrence on NPRI's tax study

Listen to the podcast here.

With news breaking yesterday that Nevada's on-again, off-again tax study is on again, it has never been more important for Nevada's voters, candidates and elected officials to understand and pay attention to the debate over taxes in Nevada.

While the legislature's tax study is likely to call for a substantial increase in taxes and the creation of a corporate income tax, there is a better way. NPRI fiscal policy analyst Geoffrey Lawrence has written an alternative tax study called "One Sound State, Once Again." Its revenue-neutral recommendations to broaden and stabilize Nevada's tax base include broadening and lowering the sales tax, eliminating the modified business and insurance taxes and instituting tax and spending control to stop Nevada's boom-and-bust spending cycles.

The Tax Foundation recently weighed in on different potential taxes in Nevada and warned that corporate income taxes are the "most volatile of the major taxes" and "are harmful for economic growth." The Tax Foundation notes, however, that broadening the sales tax base can improve tax revenue "stability."

To further discuss and explain these differences, the Tax Foundation interviewed Geoff for its podcast this week.

Click here to listen and click here to download the discussion.

Learn more:

Four problems with the Nevada Vision Stakeholder Group

Hello? Anybody home?

Visions of tax increases

The stakeholder two-step

Puppetmasters on the throne

Nevada's future is at stake

A 'vision' of extortion and control

IFC to hide behind unelected stakeholders

Nevadans deserve honesty from IFC

Elect your favorite mob boss

Bell, Calif., City Manager Robert Rizzo started his job at $72,000 a year, and thanks to 12 percent increases per year, saw his salary rise to nearly $800,000. He will retire with a pension of $650,000 per year - highest in California state history. His assistant made $376,000 a year. Bell's sheriff made $457,000 per year - and oversaw a mere 33 police officers (and his force is under investigation for voter fraud).

It isn't uncommon for government workers to be overpaid and underworked, but it also appears to be less common for government workers to game the system to maximize their pensions. Rizzo just scammed the system better than anyone in California history.

I've always said the Mob didn't get arrested, they just got elected. Nevada better do something fast, before we end up like our left-coast neighbor.

Breaking: The legislative tax study lives; Update: Tax study is (half) dead

Update, July 29: The Las Vegas Sun is reporting that the tax study is half dead. The portion of the tax study analyzing the state's revenue structure will not be completed, but the portion where special interests create a dream lists of projects (the Nevada Vision Stakeholder Group) will live on and present their final report by September 15.

It's alive!

Last week the Nevada News Bureau reported that the Legislative Counsel Bureau had sent Moody's Analytics, the firm hired by the Interim Finance Committee to perform Nevada's tax study, a notice of default. The notice said Moody's had 10 days to produce the report or the contract would be terminated.

But the NNB article noted that Lorne Malkiewich, director of the LCB, said an agreement could still be worked.

And the LCB has confirmed to me today that an agreement between the LCB and Moody's is currently being negotiated to complete the tax study on an extended timeline. Malkiewich told me that he expects the official announcement to come within the next day or two.

When I asked him if the revised timeline would be released at the same time a reworked contract was announced, he was noncommittal.

If the legislature is serious about having a discussion on tax policy - as Sen. Steven Horsford has claimed - it will release the study (or at least a preliminary version) no later than September 30, which would be a three month delay. This would give the public and candidates just over one month to digest and debate the study's (likely) recommendations to raise taxes and create a corporate income tax.

If there's not even a preliminary version of the tax study released by September 30, than the IFC's and Sen. Horsford's intentions will be clear: keep the voters in the dark by hiding the tax study until after the election and only then talk about creating a business tax after 53 straight months of rising unemployment.

No matter what kinds of games the IFC plays with the tax study in the coming months, I will be (pleasantly) shocked if taxpayers get any sort of look at it until after the election.

Far too often Nevada's politicians have chosen political expediency over honesty and transparency. Unfortunately it looks like that pattern is continuing.

Nevada's own Elizabeth Crum starts blogging for National Review

Elizabeth Crum of the Nevada News Bureau is taking her reporting skills to the national stage.

Elizabeth Crum of the Nevada News Bureau is taking her reporting skills to the national stage.

She's going to be covering Nevada elections at National Review Online's new blog - Battle 10.

Congrats, E!

Be sure to read the Battle 10 blog for the latest on Nevada's political races.

Why public employee salary information matters

Did they think they'd get away with this?

Bell, one of the poorest cities in Los Angeles County, pays its top officials some of the highest salaries in the nation, including nearly $800,000 annually for its city manager, according to documents reviewed by The Times.The city manager, mayor and council members all initially defended their exorbitant salaries, claiming they were just being reasonably compensated for efficiently running their city.

In addition to the $787,637 salary of Chief Administrative Officer Robert Rizzo [...] Assistant City Manager Angela Spaccia makes $376,288 annually, more than most city managers.

[...]

The district attorney is investigating Bell over the hefty compensation of its City Council members -- about $100,000 a year for part-time positions. Normally, council members in a city the size of Bell would be paid about $400 a month, Demerjian said. (Emphasis mine)

Unsurprisingly, the taxpayers of Bell didn't buy that excuse. The council members soon agreed to a 90% pay cut:

City Council members in Bell unanimously agreed Monday to give up their controversial $96,000-a-year salaries and instead draw $673 a month - a 90% decrease.What instigated these salary cuts and sudden change of heart in the city's politicians? Salary information obtained under the California Public Records Act.

This is just another example of why public record laws are necessary to ensure that local governments are run honestly. Without information empowering the public, these officials would have continued to draw exorbitant salaries.

To prevent this from happening in the future Bell (and every other town in America) should create a website dedicated to tracking public employee salaries.

Here is a video of protesters demanding the resignation of all involved:

(Cross-posted from the TransparentNevada Blog)

Dirty fighting from teacher union

The teacher unions publicly support the teaching of evolution in biology classes ... unless denying it can help their favored politician win. Allegedly, the Alabama Education Association funneled money to Republican gubernatorial candidate Robert Bentley in support of his bid to defeat fellow Republican Bradley Byrne in the party's run-off election.

According to FactCheck.org, "the teachers' PAC gave $1.5 million to 10 PACs, which in turn gave nearly $1 million to True Republican PAC. Joe Cottle, a lobbyist for the teachers' group, is the treasurer of five of the PACs, and Rudy Davidson, a former education lobbyist and a contributor to A VOTE, was treasurer of four others. Such PAC-to-PAC contributions are legal. Cottle told us they are necessary in cases when a candidate or group doesn't want to be publicly associated with AEA - which is unpopular in some circles, particularly in a Republican primary - but wants its money, or when the AEA wants to help moderate Republicans."

After the money was laundered through teacher union front groups, it was used to attack Byrne with political ads stating that Byrne supports teaching evolution, something the teacher union also supports. Now that's hypocrisy.

Hat tip to Jay P. Greene.

Read more

Read more