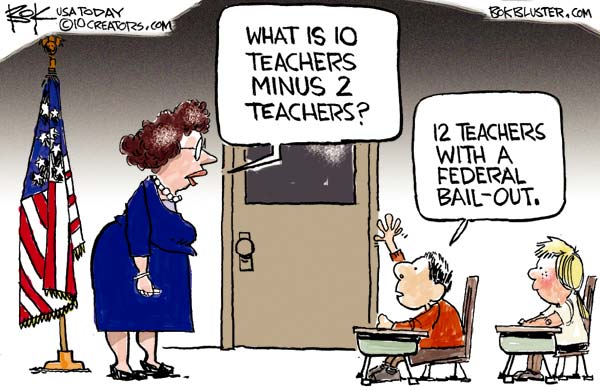

Teacher bailouts

Thanks to the teacher bailout, Nevada went from "potentially" losing "thousands" of "teachers" (with less than half of all school district employees working as classroom teachers, I've already called shenanigans on Nevada's political elites) to wanting to hire up to 1,400 more. However, throwing $83 million in one-time stimulus at education to hire more teachers (which won't improve student achievement) is just another example of bipartisan irresponsibility in the Silver State.

Wasting your money

Can you guess which federal programs in the video above are real or fake? Maybe not, but you probably did guess the programs were all a waste of your hard-earned tax dollars.

Good teachers vs. bad teachers

The L.A. Times collected data, via information request, on student achievement in the L.A. Unified School District, then handed the information over to the Rand Corporation for study. Using value added assessment, Rand and the L.A. Times found that there was a night-and-day difference between the quality of teachers at many schools. Some teachers were so bad that their students fell behind their peers. Others, so good that their students went from being below average to above average.

Unfortunately, union-imposed rules prevent school districts from rewarding high-quality teachers. Unions prefer the mind-dulling, lock-step pay system that rewards teachers for years of service rather than quality and, as a result, promotes mediocrity.

Horsford, Raggio call for record tax increases

Last week Senate Majority Leader Steven Horsford called for a $1.5 billion tax hike. And earlier this week, Anjeanette Damon reported that Senate Minority Leader Bill Raggio has also called for new taxes. Raggio didn't specify an amount, but let's just say he's hoping to do more than make the 2009 Raggio tax increases permanent.

In a brief interview today, Senate Minority Leader Bill Raggio, R-Reno, said the state's budget crisis is so great that a tax increase and an extension of the temporary 2009 tax increase may be necessary to keep government afloat.First, let's remember that Horsford has called for $1.5 billion in spending cuts, so if the budget Horsford wants is over $4.9 billion, citizens should hold the Senate majority leader to the standard he created for himself.

Second, and unfortunately, I don't have time right now to fully flesh out how tax increases kill jobs and increase government deficits over the long term, so I'm going to have to rely on the 2008 edition of Sen. Horsford and the 2008 edition of Sen. Raggio to tell you why raising taxes in a recession is a bad idea.

Via Glenn Cook, here's Sen. Horsford in 2008.

"I won't support tax increases -- not when the private sector is losing revenue and losing jobs," Horsford told the Review-Journal's editorial board in September [2008].And here's Sen. Raggio in 2008.

"The general fund needs to be managed in a way that doesn't allow growth beyond population growth and inflation."

With our citizens facing higher costs, over $4.00 per gallon for fuel and higher costs for food and other necessities, businesses hurting, unemployment rising, this is not the time to talk about raising taxes.What should Nevada do instead of raising taxes? Rory Reid and Brian Sandoval both have suggestions that would help correct the 29 percent increase in inflation-adjusted, per-capita spending that Nevada's had over the last 15 years.

For example, here's Reid's take on the out-of-control education bureaucracy.

Democrat gubernatorial candidate Rory Reid told the Nevada News Bureau yesterday there are other options for moving the state out of its current budget crisis besides increasing taxes and cutting programs.Reforms like these, not tax increases, will be the ones that take political courage. Sen. Horsford and Sen. Raggio didn't even keep their promises to oppose tax increases for one year.

In an interview at a local coffee shop, Reid pulled out two pieces of paper. One showed an organization chart for the state's public education system from 1989. The other shows how it looks now.

The newer chart showed many more layers of government, including advisory panels, legislative committees and other bureaucratic creations that have evolved over the past 20 years.

Reid said the two charts demonstrate one way Nevada can save several hundred million dollars: by streamlining government services to eliminate redundancies and inefficiencies in state government.

Nevada's citizens should do their best to discover if either Reid or Sandoval have a greater amount of political courage and integrity than Sen. Horsford and Sen. Raggio have shown.

ReasonTV: Union jobs vs. Children's lives: Which side are you on?

Given that Congress just passed a government jobs bill aimed mostly at teachers, this question from ReasonTV is both timely and important.

More ReasonTV here.

Say what?

What? We just went from possibly firing teachers if we didn't get a "stimulus" to being able to hire 1,400 NEW teachers?

And by the way, the "1,000" teacher jobs lost were mostly through attrition not because the education budgets were "significantly" reduced. As I reported earlier this year, K-12 education will probably spend more this biennium than in the last.

Rothbard on deflation

Kudos to William Anderson today for drawing the relevant passages out of my favorite book, Man, Economy, and State regarding the true nature of inflation versus deflation. Nobody explains the time preference and redistributionary impacts of inflation, nor the corrective influence exerted by deflation, better than Rothbard.

Here's the key passage:

Just as inflation is generally popular for its narcotic effect, deflation is always highly unpopular for the opposite reason. The contraction of money is visible; the benefits to those whose buying prices fall first and who lose money last remain hidden. And the illusory accounting losses of deflation make businesses believe that their losses are greater, or profits smaller, than they actually are, and this will aggravate business pessimism.

It is true that deflation takes from one group and gives to another, as does inflation. Yet not only does credit contraction speed recovery and counteract the distortions of the boom, but it also, in a broad sense, takes away from the original coercive gainers and benefits the original coerced losers. While this will certainly not be true in every case, in the broad sense much the same groups will benefit and lose, but in reverse order from that of the redistributive effects of credit expansion. Fixed-income groups, widows and orphans, will gain, and businesses and owners of original factors previously reaping gains from inflation will lose. The longer the inflation has continued, of course, the less the same individuals will be compensated.

Some may object that deflation "causes" unemployment. However, as we have seen above, deflation can lead to continuing unemployment only if the government or the unions keep wage rates above the discounted marginal value products of labor. If wage rates are allowed to fall freely, no continuing unemployment will occur.

Union official in deep, deep denial

They say that breaking through denial is the first step to recovery. If that's the case, than AFL-CIO chief Richard Trumka has long ways to go, because as you'll see in this clip, his denial about the deficit runs deep.

The national debt is currently $13.3 trillion and counting. Anyone who thinks that isn't a problem hasn't been paying attention.

Also of note is this great column by Dustin Siggins, who introduces an important term - the "Debt Paying Generation."

In the near future, The Heritage Foundation's Bill Beach and I will officially introduce the soon-to-be-important term "The Debt-Paying Generation," (DPG) a term that all Americans should become familiar with. It is the financial future of America, and not a pretty one at that.Read the whole thing.

What is the DPG? It is those Americans who are presently between 5 and 30, and will be hardest hit from childhood through death by the debt irresponsibility in Washington. According to calculations broken down from Census Bureau data, the DPG is approximately 35% of the total American population, and currently stands at 108,670,000. Given expected life spans- nearly 80 years old on average, and having increased an average of three years since 1990- it is not impossible to believe that the DPG will be the longest-lived generation in American history.

Why is this age group being named the "Debt-Paying Generation?" Well, primarily because this generation will almost certainly have to pay down most of our national debt through higher taxes, which almost certainly will relegate them to the status of being the first generation of Americans to live a worse life than its immediate predecessors. Additionally, to rub salt in the wound, the big three entitlement programs-Social Security, Medicare, and Medicaid-will have to be cut and, thus, will pay less to the Debt Paying Generation than the Boomers.

The government vs. everyone else

Not only could Nevada fire 1,660 teachers (assuming no $83 million "teacher" bailout) and see no negative effects in student achievement, but teachers would still have a safer job than most of the private sector in Nevada. Of course, actual teachers make up less than half of all school district employee so why would the bailout magically save ONLY teacher jobs?

Oh, and it appears Democrats may be trying to pay for the teacher bailout by creaming money from the Food Stamps program. Yes, robbing poor hungry Americans to subsidize teachers who already earn incomes that are higher than the national average.

That is tragic, but this is comic: the Milwaukee teacher union is fighting to use the bailout money to get Viagra covered by their health insurance plan. A stimulus indeed.

Yes, the latest bailout is just another payoff from congressional Democrats to their local union buddies. HT: JPGB

Monthly reminder: The stimulus was and is an epic failure

July's unemployment rate - still at 9.5% - came out last Friday, so it's time for yet another reminder of what an epic failure the stimulus was and is.

Remember the standard that I'm comparing the stimulus to is the standard Obama and Reid set for the stimulus themselves. They used the chart below to justify passage of the stimulus and believers in the free market should use it now to show how bankrupt Obama and Reid's economic policies are. And unfortunately, the bad news keeps coming. Nevada's unemployment rate - already the nation's highest - will be substantially higher than the national rate, once state data is released.

And unfortunately, the bad news keeps coming. Nevada's unemployment rate - already the nation's highest - will be substantially higher than the national rate, once state data is released.

Two things: Since the first stimulus was such an object failure, why are Obama and Reid trying to pass another one?

Also, this is the perfect reminder of why it's not the government's job to create jobs. When the government tries to create jobs, it simply make things worse.

Good intentions are not enough. Ideas have consequences and when the government institutes bad policy, bad results follow.

Read more

Read more