Thoughts from the gubernatorial candidates' debate

Rory Reid and Brian Sandoval had their second debate last Thursday. You can watch the whole thing here.

A few thoughts:

First, I was disappointed that neither candidate took the opportunity to accurately define Nevada's budget situation as I had hoped someone would do. I'm not really surprised. Each candidate's goal is to win the debate, not correct a false narrative. Still, it was disappointing, and if either candidate is serious about his repeated promises not to raise taxes, he needs to correct the false beliefs about the size of Nevada's projected budget deficit.

Second, the first question of the debate was once again based on faulty information. The first question (6:45 mark) was: "Andrew Clinger, Republican Governor Jim Gibbons' state budget director, said in order to balance the budget without raising taxes you'd have to eliminate all funding of state government except K-12 and higher education. That means eliminating health and human services, taxation, gaming enforcement, even the legislature and the Supreme Court. He says he doesn't know how to balance Nevada's budget without raising taxes. Both of you have said raising taxes isn't necessary. Do you know something that the state budget director doesn't know?"

The quote is based on testimony that Clinger gave at a hearing in August. The problem is that statement wasn't true then and isn't true now - according to Clinger's numbers!

Also, Clinger has said that he is creating "a two-year budget of about $5 billion, about $1.5 billion less than the current two-year budget."

Believers in limited government may not know more about the budgeting process than the state budget director, but we are aware of the numbers, not just the rhetoric, he's using.

Third, NPRI's tax study was mentioned at about the 24-minute mark. It's good to see that the public is continuing to recognize the good work NPRI is producing. Sure this is shameless self-promotion, but it's also a very good proposal.

October (not really a) surprise: Unemployment numbers worse than expected

Another month, another reminder that the stimulus was and is an epic failure.

Payrolls fell in September by 95,000 jobs because of layoffs by the government while the unemployment rate remained stuck at 9.6 percent, the Labor Department reported Friday. The news drove stocks higher with investors betting the government will do more to boost the economy.

The jobless rate has now topped 9.5 percent for 14 straight months, the longest stretch since the 1930s. The private sector added 64,000 jobs, the weakest showing since June.

The drop in payrolls disappointed many economists, who expected payrolls would be about even for September compared with the previous month.

This chart is originally from Innocent Bystanders in June 2010. I've added the last four data points myself, because I can't find a more updated chart on their site. Innocent Bystanders should get credit for the original chart and idea.

Also, the AP reports that 72,000 stimulus checks went to dead people. What? Sending money to dead people doesn't improve the economy? I'm shocked, shocked.

Higher-education bubble

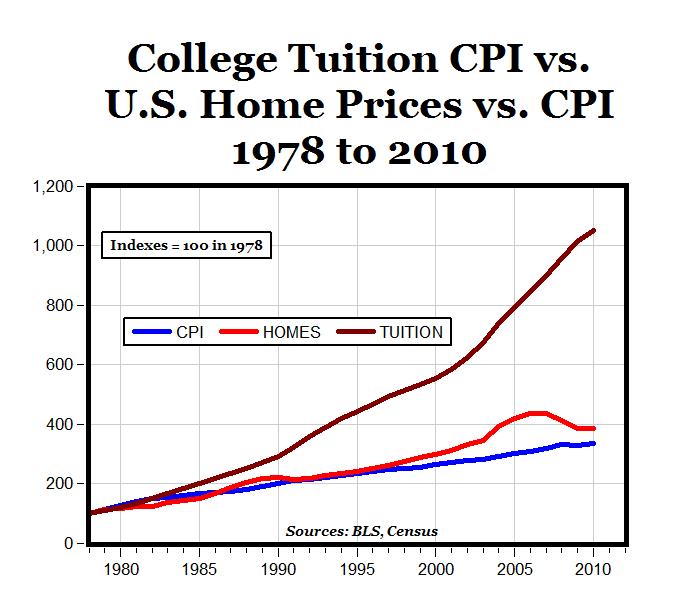

Table 1: U.S. housing price index vs. U.S. higher education tuition

My latest article on higher education budget cuts and financing shows that 1) the budget cuts have been smaller than advertised (10 percent rather than 30 to 50 percent), 2) smaller than the dramatic growth in revenue in the preceding 17 years (at least) and 3) financing is being crowded out by declining state revenues and new spending priorities (like ObamaCare).

A previous article highlighted how Nevada's universities use new revenue to hire highly paid non-educators (read: administrators) and luxurious ameneties for students (nicer dorms, better cafeterias, massive gymnasiums). UNLV, for example, actually decreased the number of educators while increasing the number of administrators.

So even though Nevada's universities are mispending scarce resources on non-educators they are facing a tougher financial time than they're used to; but that doesn't mean we should hand over more tax dollars or dramatically increase tuition and fees on students.

Just looking at the last 10 years alone shows a large spike in tuition and fees for higher education. From the 2000-01 school year to 2009-10, UNLV's and UNR's published tuition and fees increased 73.9 percent and 64 percent, respectivly (inflation-adjusted). The most dramatic jump has been in student fees.

Note: total price includes tuition, fees, books, supplies and the cost of living on campus.

Table 2: Inflation adjusted price increase in Nevada higher education from 2000 to 2010.

Worse still, tuition and fees continue to rise. Even though the Consumer Price Index fell by 0.4 percent between 2008 and 2009 and has only grown 1.76 percent since last year, the Nevada System of Higher Education Board of Regents approved a statewide 5 percent increase in undergraduate tuitions. The hyperinflation in higher education is simply unsustainable.

This rapid increase in revenue has not increased the quality of either UNR or UNLV. No student is learning 60 to 70 percent more, even though students are paying 60 to 70 percent more in tuition and fees than students from just 10 years ago.

Both universities must learn to live within their means while providing a higher-quality service at a reasonable (and probablay lower) cost/price. If we don't fix the problem now, then the higher-education bubble burst will - and the situation will be even more painful then.

Will Reid or Sandoval accurately describe Nevada's projected budget deficit during tonight's debate?

Gubernatorial candidates Rory Reid and Brian Sandoval will meet tonight for another debate. The Nevada Broadcasters Association is hosting the debate and said today in an e-mail newsletter that the most important part of the debate will be finding out each candidate's specific plan for addressing the state's budget situation.

While each candidate's budget plan is important, what's even more important is for Reid and Sandoval (or even the moderator, if he/she cares about accuracy) to accurately describe Nevada's projected budget deficit.

As NPRI reported last month and State Budget Director Andrew Clinger confirmed two days ago, Nevada doesn't have a $3 billion projected budget deficit. Nevada only has a $3 billion deficit if you assume a massive, $1.8 billion spending increase. That's a 28 percent spending increase from our current $6.4 billion general-fund budget.

Both Reid and Sandoval have publicly stated that they do not support raising taxes, but this position is less tenable politically if the general public believes the widespread lie that Nevada is facing a $3 billion, 50 percent budget deficit.

If either candidate is serious about implementing a budget without tax increases, he must redefine how the budget discussion is being framed, and tonight's debate - with a large portion of the electorate watching - is the best time to do that.

As I wrote on Tuesday:

If politicians and the media can convince the general public (like they have been trying to do) that increasing spending by 28 percent - from $6.4 billion to $8.2 billion - will keep services at existing levels, they win. It's that simple.Reid and Sandoval are opponents in the election and the debate, but on this one issue they should have agreement. Tonight, both have a chance to provide the clarity that Nevada's budget debate so desperately needs.

It's all about the assumptions the public is making. If the public believes that a $1.8 billion spending increase is "keeping services at their current level," tax increases are inevitable, because a spending increase is assumed. But if the public discovers the truth - that a $1.8 billion spending increase is, in fact ... a $1.8 billion spending increase, believers in a limited, accountable government have a chance to begin the debate about the size of government on equal footing. [Spending increase numbers updated from $1.5 billion to $1.8 billion to reflect the latest from Clinger.]

Reid and Sandoval should clash and have a vigorous debate - but only after the terms of that debate (Nevada's projected budget deficit) have been defined accurately.

Firefighters in Clark County receive pay in 73 different categories

After I posted a video yesterday showing Henderson firefighters getting paid to work out, my colleague and firefighter-salary expert Geoffrey Lawrence came over to my office and informed me that there was something wrong with my post.

The point of the post was to show how misleading is firefighter union spokesman Ryan Beaman's statement that "[T]he average pay for a firefighter in Clark County is $23.80 per hour and that is not unreasonable." The post pointed out how the hourly rate for the 24-hour shifts that firefighters work isn't comparable to the wage the average person makes for an eight-hour shift, because firefighters get paid to sleep and workout.

"Uh-oh," I thought. "What kind of mistake did I make? Did I misrepresent what Beaman was saying?"

Nope. The problem is that I didn't fully explain how misleading Beaman's statement is. Geoff told me that Beaman was only referring to base pay.

Firefighters, he informed me, earn pay in 73 - yes, 73 - different categories, including overtime, call back, premium pay for certifications, merit pay and remote areas.

The pay the average firefighter receives in these 73 different categories doubles the firefighter's base-pay salary.

That's right: Even while working 24-hour shifts and getting paid to sleep and workout, firefighters in Clark County make more than $47 per hour, plus $30,000 to $50,000 in benefits a year.

As for Ryan Beaman ... at least he knows a lot of firefighters for when his pants catch on fire.

Clinger finally publicly admits that Nevada's projected budget deficit contains a huge spending increase

Finally, finally, finally. After six months of distortions and factual inaccuracies, Nevada's budget director Andrew Clinger has finally been clear, honest and upfront about Nevada's budget situation. (Of course, if you watched 90 for 90 or read "The $3 billion deficit myth" you'd already know the truth).

In an interview on "Face to Face" yesterday (props to Ralston for citing NPRI and asking Clinger directly about the budget number), Clinger said this: "What you're talking about and what NPRI is talking about is the current two-year budget when we look at general fund appropriations ... So when you look at just the general fund appropriations we're going from [$]6.4 [billion] to [$]8.2 [billion]. So we're increasing appropriations $1.8 billion."

Clinger's statement comes during Block 2 of the 10/05 episode at 1:11 mark.

What's ironic about this exchange is that NPRI has never disagreed with Clinger's numbers - in fact, Clinger is the source of our numbers!

What Clinger had not been making clear, and what we had objected to, was that the "$3 billion deficit" he talks so much about assumed a $1.8 billion increase in general fund appropriations, a.k.a. a $1. 8 billion spending increase.

I'm grateful that he clarified this and I hope that every reporter, politician and citizen in the state begins to fully understand and accurately frame this debate.

Win, lose or draw, this is a fair debate: Should Nevada increase spending by $1.8 billion (28 percent!), should we reduce spending by $1.5 billion as even liberal Sen. Majority Leader Steven Horsford has suggested, or should we do some combination of both?

If you or Sen. Horsford is looking for ideas on how to reduce spending, there are plenty available.

Video: Firefighters getting paid to workout

Firefighters in the Las Vegas area are grossly overpaid. The average Clark County firefighter made $129,476 last year. The average Las Vegas firefighter made $123,427 last year. The average Henderson firefighter made $115,963. And none of these salary numbers include the $30,000 - $50,000 benefits package each firefighter earns.

To justify these inflated salaries, firefighter union spokesman Ryan Beaman is often quoted as saying, "[T]he average pay for a firefighter in Clark County is $23.80 per hour and that is not unreasonable."

It doesn't sound unreasonable, until you realize that firefighters in Clark County work 24-hour shifts, which means they are paid to sleep, eat and workout - like the firefighters in the video below.

Yep, those firefighters are on the clock. And this isn't a rare occurrence. I've seen them at that 24-Hour Fitness many times before.

I don't mind that firefighters work 24-hour shifts or get paid to workout while on those shifts. What I do mind is Beaman attempting to mislead the public by pretending a firefighter's hourly rate is comparably to the general public's.

Fortunately, the public is getting wise to how firefighters are ripping off Clark County taxpayers.

90 for 90: Nevada's projected-budget-deficit myth

Welcome to the debut of a new video series that we here at Write on Nevada will be breaking out for the most important issues facing our state.

The series is called "90 for 90," and its premise is simple: You give us 90 seconds and you'll know more about a certain issue than 90 percent of Nevadans.

This video explains what is the most important issue facing the legislature in 2011 - Nevada's projected budget deficit. Widely reported distortions from Andrew Clinger, the state's budget director, have led many to believe that Nevada faces a $3 billion, 50 percent budget deficit. As you'll see in the video below, though, that isn't the case - you give us 90 seconds and you'll know more than 90 percent of Nevadans.

If you need more proof of how important the framing of the budget deficit is, check out the opinion poll being reported by the RJ.

In funding human services programs such as food stamps, welfare and children's programs, what would you do?First, given that there's no option for reform or eliminating waste, it's impressive that 31 percent selected less government. Second, nearly half want to maintain the current level of service.

Raise taxes to improve human services such as these: 17.8%

Raise taxes just enough to keep these services at existing levels: 46.8%

Eliminate or reduce these services rather than raise taxes: 31%

Don't know/undecide: 4.3

But what is the current level of service? If politicians and the media can convince the general public (like they have been trying to do) that increasing spending by 23 percent - from $6.4 billion to nearly $8 billion - will keep services at existing levels, they win. It's that simple.

It's all about the assumptions the public is making. If the public believes that a $1.5 billion spending increase is "keeping services at their current level," tax increases are inevitable. But if the public discovers the truth - that a $1.5 billion spending increase is, in fact ... a $1.5 billion spending increase, believers in a limited, accountable government have a chance to begin the debate about the size of government on equal footing.

But for conservatives and libertarians, the first debate to be won is the debate over the terms on which the debate takes place. And that's why this "90 for 90" video is so important.

If you agree, please pass it on to your friends and colleagues.

(h/t to The Sports Guy for inspiring the great title idea)

Can we call them socialists if that's what they call themselves?

Many on the left accuse those on the right of name-calling, when conservatives, libertarians and/or members of the TEA Party movement call leftist politicians "socialists."

Looks like someone forgot to give that memo to the leftists attending the labor-union-organized "One Nation Working Together" rally. The rally was held last Saturday, and socialism was proudly displayed by many, many leftists.

Fortunately for those who value freedom and liberty, the "One Nation" rally couldn't touch the attendance of Glenn Beck's recent rally.

Gibbons earns a B

Governor Jim Gibbons may have lost a primary election to Brian Sandoval and he may be out of the office with a broken pelvis, but at least he will officially leave office having received some high marks for his actions as governor of Nevada.

The Cato Institute graded Governor Gibbons with a "B" (yes, it was on a curve) for his work on the state budget. Gibbons' score of 61 was enough to rank him tied for eighth best among U.S. governors, according to the Cato Institute's metric. Governor Gibbons tied with Rick Perry (R) of Texas, Bob Riley (R) of Alabama and Brian Schweitzer (D) of Montana.

The Cato Institute writes,

Nevada is enduring tough economic times, and government tax collections have fallen substantially. Governor Gibbons has generally refused to increase taxes to make up for the shortfall because that would make the economic situation even worse. In proposing spending cuts rather than tax increases to balance the budget, Gibbons noted, "It is not the role of the state government to put people out of work." He said the government would be "piling on" the difficulty that citizens and businesses are already having if it raised taxes. Gibbons has proposed business tax cuts and opposed and vetoed numerous tax increases. In 2009, he vetoed a big increase in sales and payroll taxes, but the legislature overrode his veto. Gibbons has supported some modest tax increases, but he seems to understand that broad-based increases would damage the state's pro-enterprise environment.

And in case you are wondering, yes, three Democrat governors scored higher than Governor Gibbons: Joe Manchin (West Virginia), Dave Freudenthal (Wyoming) and Brad Henry (Oklahoma).

Read more

Read more